Introduction

In today’s digital economy, chargebacks are a critical part of financial transactions, especially in e-commerce. A chargeback is a transaction reversal initiated by the cardholder’s issuing bank. It’s designed to protect consumers from fraud, errors, and unauthorized transactions. Understanding chargebacks is crucial for consumers protecting their financial interests and merchants aiming to reduce losses.

What is a Chargeback?

A chargeback reverses funds after a customer disputes a transaction with their credit card issuer. Unlike a refund, initiated by the merchant, a chargeback is processed by the issuing bank, often without the merchant’s input. Chargebacks protect consumers from fraudulent transactions and merchant errors.

Visa data shows that about 58% of chargebacks are due to fraud, 26% to customer disputes, and 16% to processing errors. Understanding these causes is key to mitigating their impact.

How Does a Chargeback Work?

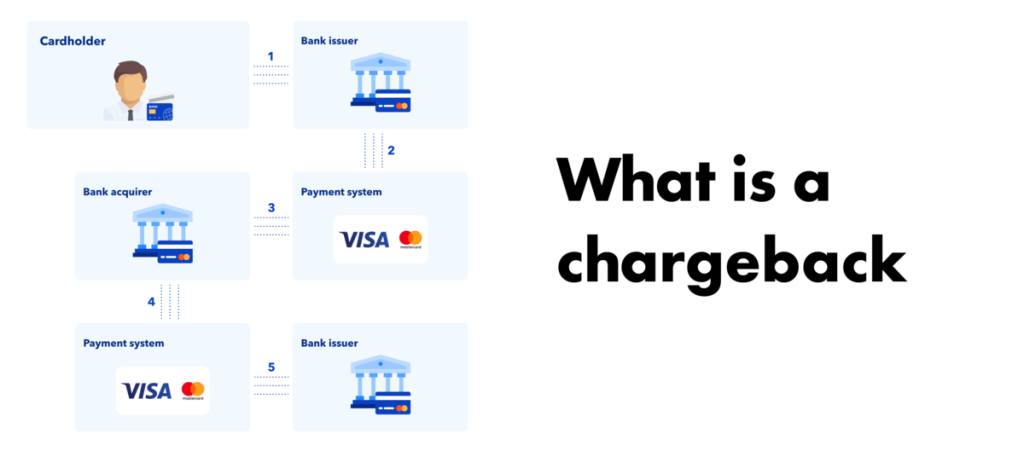

The chargeback process involves several steps:

- Customer Disputes the Charge: The process begins when a cardholder contacts their issuing bank to dispute a charge. The bank assigns a chargeback reason code based on the customer’s explanation, such as “fraudulent transaction” or “goods not received.”

- Issuing Bank Reviews the Dispute: The issuing bank conducts a preliminary investigation and may provisionally credit the customer’s account while the chargeback is processed.

- Merchant Receives a Chargeback Notice: The merchant is notified of the chargeback and is given the opportunity to provide evidence that the charge was valid. This could include receipts, delivery confirmations, or communication records with the customer.

- Resolution and Funds Transfer: The issuing bank reviews the evidence provided by both parties. If the chargeback is upheld, the funds are permanently reversed from the merchant’s account. If the merchant’s evidence is compelling, the chargeback may be reversed, and the funds restored to the merchant.

Common Reasons for Chargebacks

Understanding the common causes of chargebacks is essential for merchants to develop effective prevention strategies. The most frequent reasons for chargebacks include:

- Fraudulent Transactions: Unauthorized use of credit card information, which accounts for a significant percentage of chargebacks.

- Merchant Errors: Duplicate charges, incorrect amounts, or failure to deliver goods/services.

- Customer Dissatisfaction: Discrepancies between the product description and the actual product received, leading to disputes.

- Friendly Fraud: When customers file chargebacks on legitimate transactions to avoid payment.

Impact of Chargebacks on Businesses

Chargebacks are a significant financial burden for merchants. According to Mastercard, the average chargeback cost for merchants can be $15 to $100 per incident, including fees and lost revenue. Merchants with excessive chargebacks may face penalties from payment processors, including higher processing fees or termination of their merchant accounts.

Below is a table outlining the potential costs associated with chargebacks:

| Chargeback Component | Estimated Cost per Incident |

|---|---|

| Chargeback Fees | $15 – $100 |

| Lost Revenue (Average Order) | $100 – $500 |

| Administrative Costs | $20 – $50 |

| Increased Processing Fees | Varies |

| Potential Account Termination | Severe Financial Impact |

Preventive Measures for Chargebacks

Preventing chargebacks requires addressing common causes of disputes. Merchants should:

- Communicate Clearly: Ensure product descriptions are accurate and complete.

- Bill Transparently: Ensure the business name on credit card statements matches the name the customer knows.

- Provide Strong Customer Service: Resolve customer complaints quickly to avoid escalation to chargebacks.

- Use Fraud Prevention Tools: Implement fraud detection software and require strong customer authentication methods.

Partnering with chargeback prevention services can also reduce risk. Merchanto.org, an official partner of Visa and MasterCard, offers solutions to monitor and prevent chargebacks. Learn more about their services here.

Legal and Regulatory Aspects

Chargebacks are governed by various regulations depending on the type of transaction and the payment network. In the United States, chargeback rights for credit cards are governed by Regulation Z of the Truth in Lending Act, which mandates that issuers must offer chargebacks within 60 days of the date of billing. For debit card transactions, Regulation E under the Electronic Fund Transfer Act provides similar protections.

Chargeback Codes and Their Meaning

Each chargeback is assigned a reason code by the card network, indicating why the chargeback was filed. Understanding these codes is crucial for merchants when disputing chargebacks. Below is a table summarizing common chargeback codes used by Visa and Mastercard:

| Reason Category | Visa Reason Code | Mastercard Reason Code | Common Examples |

|---|---|---|---|

| Fraud | 10.4 | 4863 | Card not present, counterfeit transactions |

| Customer Service Issues | 13.1 | 4855 | Product not received, defective goods |

| Clerical Errors | 12.6 | 4999 | Duplicate transaction, incorrect amount |

| Authorization Issues | 11.1 | 4812 | No authorization, expired card |

Chargeback Trends and Statistics

The global chargeback rate has been steadily increasing, with an estimated $31 billion lost to chargebacks in 2021, according to a report by Juniper Research. This number highlights the growing challenge merchants face in managing chargebacks and the need for effective prevention strategies.

| Year | Estimated Global Chargeback Losses |

|---|---|

| 2019 | $20 billion |

| 2020 | $25 billion |

| 2021 | $31 billion |

| 2022 | $35 billion (estimated) |

Conclusion

Chargebacks provide essential protection for consumers against fraud and errors but present significant challenges for businesses. By understanding the chargeback process, common causes, and effective prevention strategies, merchants can reduce their chargeback rates and protect their revenue.

This straightforward approach to understanding and managing chargebacks ensures that businesses and consumers alike are better equipped to navigate the complexities of modern transactions.