Chargebacks, where a customer disputes a transaction and the bank reverses the payment, pose a significant challenge for businesses. Beyond the immediate loss of sales, chargebacks lead to penalties, potential account suspension, and long-term damage to business reputation. In 2023, global losses due to chargebacks exceeded $20 billion, underscoring the need for effective chargeback management strategies.

Understanding Chargebacks

Chargebacks occur for several reasons:

- Fraudulent Transactions: This accounts for 55% of all chargebacks, where unauthorized card use leads to disputes.

- Product or Service Dissatisfaction: About 20% of chargebacks result from unmet customer expectations.

- Technical Errors: Double billing or incorrect charge amounts cause 10% of chargebacks.

- Friendly Fraud: 15% of chargebacks occur when customers exploit the chargeback process.

The consequences of high chargeback rates extend beyond revenue loss. Businesses may face increased transaction fees and possible termination of their merchant accounts if their chargeback ratio exceeds the industry-standard threshold of 1%.

Impact of High Chargeback Rates

High chargeback rates carry hidden costs. According to VISA, every dollar lost to fraud costs businesses $3.75 when considering chargeback fees, administrative costs, and increased payment processing fees. Additionally, high chargeback rates can lead to:

- Merchant Account Suspension: Payment processors like Stripe or Braintree may suspend accounts with excessive chargebacks.

- Increased Processing Fees: Businesses with high chargeback ratios often incur higher fees from payment processors.

- Reputation Damage: Frequent chargebacks can harm customer trust and reduce future sales.

Proactive Strategies to Reduce Chargebacks

Reducing chargebacks requires a proactive approach, focusing on fraud prevention, customer satisfaction, and internal processes.

Fraud Prevention Techniques

Implementing robust fraud prevention measures is crucial. Mastercard recommends the following strategies:

- Fraud Detection Tools: Use tools such as CVV (Card Verification Value), AVS (Address Verification Service), and 3D Secure to verify cardholder identity. These tools can reduce fraud-related chargebacks by up to 50%.

- Multi-Factor Authentication (MFA): Implement MFA for high-risk transactions. Stripe reports that MFA can decrease fraud incidents by up to 60%.

- Transaction Monitoring: Regularly monitor transaction patterns to identify unusual behaviors that may indicate fraud.

Enhancing Customer Experience

Customer dissatisfaction is a major driver of chargebacks. Improving the customer experience can significantly reduce disputes.

- Detailed Product Descriptions: Ensure product descriptions are accurate, including clear images, dimensions, and features. A Braintree study found that 30% of chargebacks stem from unclear or misleading product information.

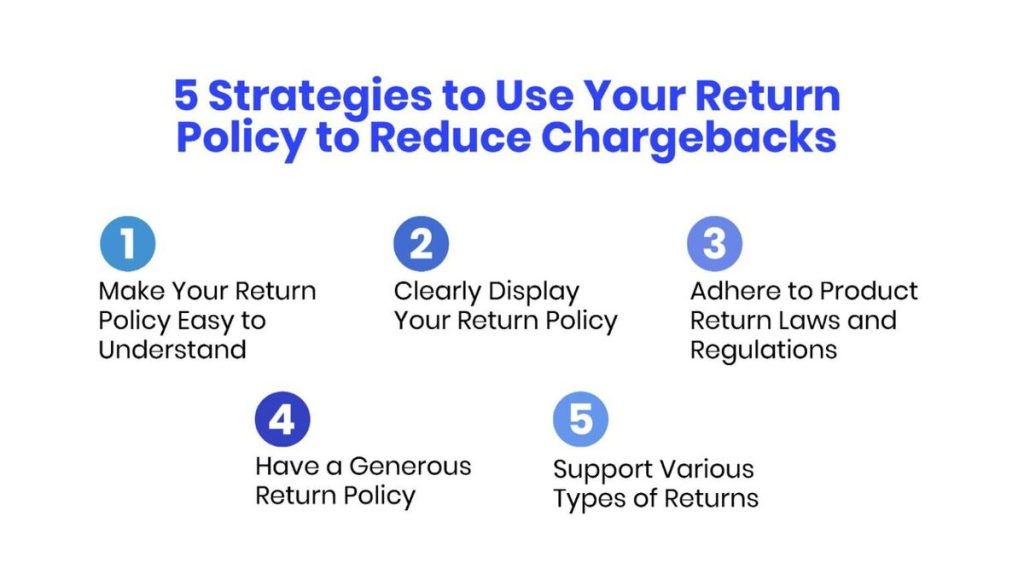

- Clear Return Policies: Outline return and refund policies clearly on your website. Checkout.com found that businesses with clear return policies see a 25% reduction in chargebacks.

- Shipping Transparency: Provide customers with tracking information and expected delivery times. Late or undelivered products are a leading cause of chargebacks.

Merchanto.org, an official partner of VISA and MasterCard in chargeback prevention, offers solutions integrating fraud detection and customer experience enhancements. For more information, visit Merchanto.org.

Merchant Best Practices

In addition to fraud prevention and customer experience improvements, merchants should adopt best practices to minimize chargebacks.

- Clear Billing Descriptors: Use recognizable billing descriptors that include your business name and contact information. This simple step can reduce chargebacks by 20%.

- Employee Training: Ensure staff are trained in handling transactions correctly, avoiding common errors that lead to chargebacks, such as incorrect billing amounts.

- Regular Review of Transaction Data: Analyzing transaction data can help identify patterns leading to chargebacks. Businesses that regularly review their data see a 15% decrease in chargeback rates.

Responding to Chargebacks Effectively

Even with the best prevention strategies, chargebacks may still occur. Effective management of the chargeback process is crucial.

- Collect Evidence: Gather all relevant documentation, including transaction records, customer communications, and delivery confirmations, to dispute illegitimate chargebacks.

- Engage with Payment Processors: Work with your payment processor to contest chargebacks and understand the underlying reasons. Visa’s Dispute Monitoring Program (VDMP) and Mastercard’s Excessive Chargeback Program (ECP) can assist merchants in managing disputes.

- Use Technology: Leverage chargeback management tools that automate the dispute process, ensuring timely and accurate responses.

Conclusion

Chargebacks present a significant challenge for businesses, impacting both revenue and customer relationships. However, with a well-structured approach focused on fraud prevention, customer experience, and internal operational practices, businesses can effectively reduce their chargeback rates. Implementing robust fraud detection tools, ensuring clear communication with customers, and adopting best practices in transaction processing are key strategies. By continuously monitoring and refining these strategies, businesses can safeguard their revenue and maintain strong relationships with their customers.

Tables

- Common Causes of Chargebacks

| Cause | Percentage of Total Chargebacks | Example Scenarios |

|---|---|---|

| Fraudulent Transactions | 55% | Unauthorized use of card details |

| Product Dissatisfaction | 20% | Product not as described |

| Technical Errors | 10% | Double billing, incorrect charges |

| Friendly Fraud | 15% | Customer exploits chargeback process |

- Impact of High Chargeback Rates

| Consequence | Description | Percentage Impact on Business Costs |

|---|---|---|

| Merchant Account Suspension | Payment processors may suspend accounts with high ratios | 30% increased risk |

| Increased Processing Fees | High chargeback ratios lead to higher transaction fees | Up to 5% increase |

| Reputation Damage | Frequent chargebacks harm customer trust | 25% decrease in repeat customers |

- Fraud Prevention Tools and Their Effectiveness

| Tool | Effectiveness in Reducing Fraud | Recommended By |

|---|---|---|

| CVV (Card Verification) | Reduces fraud by up to 30% | Mastercard |

| AVS (Address Verification) | Prevents fraud in 20% of cases | Visa |

| 3D Secure | Decreases fraud by 50% | Stripe |

| Multi-Factor Authentication | Lowers fraud incidents by 60% | Checkout.com |