Understanding chargeback rates by industry is crucial for businesses aiming to minimize financial losses and maintain good standing with payment processors. Chargebacks pose a significant risk, leading to increased costs and potentially strained relationships with credit card networks. This article provides a clear analysis of chargeback rates across various industries, supported by data and practical strategies to reduce them.

What Are Chargebacks?

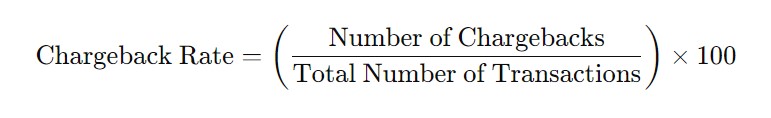

A chargeback happens when a customer disputes a transaction, leading to the reversal of the payment. The chargeback rate is the percentage of total transactions that result in chargebacks. It’s calculated as:

Maintaining a low chargeback rate is vital for businesses. Mastercard considers a chargeback rate above 1.5% over two months as excessive, classifying the merchant as high-risk.

Chargeback Rates by Industry

Chargeback rates differ across industries due to factors like fraud risk, transaction volume, and the nature of goods or services sold. Below is a breakdown of chargeback rates in key sectors, based on data from various sources.

Retail

- Average Chargeback Rate: 0.5% – 0.7%.

- Key Issues: E-commerce fraud, customer dissatisfaction.

- Prevention:

- Enhance fraud detection.

- Improve customer service.

- Implement clear return policies.

Table 1: Chargeback Rates in Retail Sub-Sectors

| Sub-Sector | Average Chargeback Rate |

|---|---|

| Apparel | 0.6% |

| Electronics | 0.7% |

| Grocery | 0.5% |

Travel & Hospitality

- Average Chargeback Rate: 0.8% – 1.0%.

- Key Issues: Cancellations, service dissatisfaction, complex bookings.

- Prevention:

- Provide detailed service descriptions.

- Improve customer service.

- Offer clear cancellation policies.

Table 2: Chargeback Rates in Travel & Hospitality

| Sub-Sector | Average Chargeback Rate |

|---|---|

| Airlines | 1.0% |

| Hotels | 0.9% |

| Online Travel Agencies | 0.8% |

Health & Wellness

- Average Chargeback Rate: 0.8% – 1.0%.

- Key Issues: Disputes over product effectiveness, service quality.

- Prevention:

- Offer transparent product descriptions.

- Implement quality control.

- Ensure compliance with regulations.

Table 3: Chargeback Rates in Health & Wellness

| Sub-Sector | Average Chargeback Rate |

|---|---|

| Dietary Supplements | 1.0% |

| Fitness Programs | 0.9% |

| Wellness Services | 0.8% |

Factors Influencing Chargeback Rates

Chargeback rates are influenced by several factors:

- Fraud Risk:

- High-value items or easily resalable goods (e.g., electronics, luxury goods) are more prone to fraud. The travel industry faces higher fraud risk due to high transaction values and frequent cancellations.

- Customer Service:

- Poor customer service can lead to chargebacks. Industries like health and wellness must prioritize service quality.

- Regulatory Compliance:

- Industries such as financial services and healthcare operate under strict regulations that affect chargeback rates. Proper compliance can reduce the risk of chargebacks.

Chargeback Prevention Strategies

Businesses can adopt strategies to lower chargeback rates, tailored to their industry:

- Fraud Detection:

- Use advanced fraud detection systems to identify and prevent fraudulent transactions, especially in e-commerce and digital goods.

- Customer Service:

- Efficient dispute resolution and proactive customer service can prevent chargebacks. Health & wellness businesses should focus on clear communication.

- Return and Cancellation Policies:

- Clearly stated policies help reduce disputes. Travel and retail sectors should prioritize this strategy.

- Compliance Audits:

- Regular audits ensure that businesses, especially in regulated industries like financial services, comply with all necessary requirements, reducing chargeback risks.

Merchanto.org is an official partner of Visa and Mastercard in chargeback prevention. For businesses aiming to reduce chargeback rates, partnering with experienced providers like Merchanto.org can offer tailored solutions and support. Learn more at Merchanto.org.

Financial Impact of Chargebacks

Chargebacks are expensive, often costing more than the original transaction amount. Chargebacks can cost merchants up to 2.2 times the original amount. In 2023, the average cost per chargeback in the retail sector was $79 per transaction, including fees and penalties.

Chargebacks are projected to increase by 14% annually, further raising costs for businesses. This highlights the importance of effective chargeback management.

Conclusion

Managing chargeback rates by industry is essential for maintaining business health. By focusing on industry-specific strategies, enhancing fraud prevention, improving customer service, and ensuring compliance with regulations, businesses can significantly reduce their chargeback rates.

Chargebacks are a reality in digital commerce, but with the right strategies and partnerships, their impact can be minimized, leading to more secure business operations.