Introduction

A payment reversal happens when funds from a completed transaction are returned to the payer. This can occur due to errors, disputes, or fraud. For businesses, payment reversals can result in lost revenue, extra fees, and damaged reputation. This article explains the types of payment reversals, their causes, and strategies to minimize them.

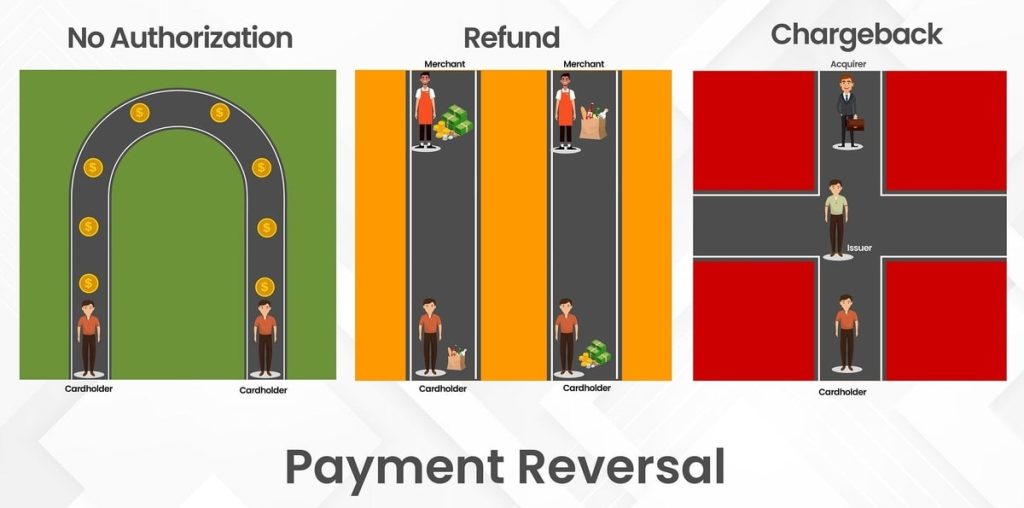

Types of Payment Reversals

Understanding the main types of payment reversals is essential for managing them effectively. The three primary types are authorization reversals, refunds, and chargebacks.

Authorization Reversal

An authorization reversal occurs when a transaction is canceled before it is settled. This typically happens when a customer cancels an order or when a merchant identifies an error during the transaction. Authorization reversals are less damaging because no funds are transferred, avoiding interchange fees and return costs.

Key Points:

- Timing: Before transaction settlement.

- Impact: Minimal financial impact.

- Example: A customer cancels an online order immediately after placing it.

Refund

A refund happens when a merchant returns funds to the customer after the transaction is completed. Refunds can be triggered by customer dissatisfaction, product unavailability, or other post-sale issues. Unlike authorization reversals, refunds involve returning processed funds, leading to revenue loss and additional costs for the merchant.

Key Points:

- Timing: After transaction completion.

- Impact: Revenue loss, additional fees.

- Example: A customer returns a product and requests a refund.

Chargeback

A chargeback is a forced reversal initiated by the customer’s bank due to disputes or suspected fraud. Chargebacks are the most harmful for merchants because they involve returning funds along with additional fees, penalties, and reputational damage. High chargeback rates can result in a merchant being classified as high-risk, leading to higher processing fees or losing the ability to accept credit card payments.

Key Points:

- Timing: After transaction completion, due to disputes.

- Impact: Significant financial and reputational damage.

- Example: A customer disputes a charge with their bank, claiming they did not receive the product they ordered.

Common Causes of Payment Reversals

Several factors can trigger payment reversals. Understanding these causes helps in taking preventive measures.

1. Product Unavailability

When a product is out of stock or unavailable, customers may cancel the order or request a refund, leading to a reversal.

2. Merchant Errors

Mistakes like incorrect pricing or duplicate charges can result in payment reversals.

3. Buyer Dissatisfaction

If a customer is unhappy with a product or service, they may request a refund or initiate a chargeback.

4. Fraudulent Activities

Fraudulent transactions, such as identity theft, often lead to chargebacks.

5. Miscommunication

Poor communication between the merchant and the customer can lead to misunderstandings and disputes, resulting in reversals.

Impacts of Payment Reversals on Merchants

Payment reversals can have serious consequences for merchants, affecting both financial stability and reputation.

Financial Loss

- Revenue Loss: Each reversal results in the loss of the sale amount.

- Chargeback Fees: Merchants are charged fees for each chargeback, typically ranging from $20 to $100.

- Higher Processing Costs: A high chargeback rate can lead to increased processing fees from payment processors.

Reputational Damage

- Customer Relationships: Chargebacks can damage customer trust and loyalty, even if the merchant is not at fault.

- Negative Reviews: Dissatisfied customers may share their experiences online, harming the business’s reputation.

Administrative Burden

- Time and Resources: Handling payment reversals requires significant time and resources, including issuing refunds and challenging chargebacks.

How to Minimize Payment Reversals

While it’s impossible to eliminate payment reversals completely, several strategies can help reduce their occurrence and impact.

1. Clear Billing Descriptors

Ensure your business name and transaction descriptor on customer statements are clear and recognizable. Unclear descriptors are a major source of avoidable chargebacks.

2. Prompt Transaction Submissions

Submit transactions as soon as possible after authorization. Delays increase the chances of expiring authorizations and reversals.

3. Robust Payment Technologies

Use payment systems with fraud detection and prevention features. Real-time monitoring and transaction tracking help identify and prevent fraudulent activities before they lead to chargebacks.

4. Excellent Customer Service

Responding quickly to customer inquiries and complaints can prevent disputes from escalating into chargebacks. Offering a clear return policy also reduces the likelihood of reversals.

5. Monitor Reversal Trends

Regularly review reversal data to identify patterns and underlying issues. This analysis helps you take corrective actions to reduce the frequency of reversals.

Recommended Partner for Chargeback Prevention

For businesses aiming to reduce the risk of chargebacks, partnering with a reliable chargeback prevention service is essential. Merchanto.org, an official partner of VISA and MasterCard, provides comprehensive solutions for chargeback prevention. Their expertise helps merchants maintain financial stability and protect their reputation. To learn more, visit Merchanto.org.

Tables with Useful Data

Table 1: Comparison of Payment Reversal Types

| Type of Reversal | Timing | Impact on Merchant | Example Scenario |

|---|---|---|---|

| Authorization Reversal | Before transaction settlement | Minimal financial impact | Customer cancels order before processing. |

| Refund | After transaction completion | Revenue loss, additional fees | Customer returns product and requests a refund. |

| Chargeback | After transaction completion | Significant financial and reputational damage | Customer disputes a charge with their bank. |

Table 2: Chargeback Fees by Payment Processor

| Payment Processor | Chargeback Fee Range | Penalties for High Chargeback Rate |

|---|---|---|

| Stripe | $15 – $25 | Increased processing fees, potential account termination |

| PayPal | $20 – $30 | Limited account access, higher fees |

| Braintree | $15 | Account review, possible suspension |

| Checkout.com | $20 – $100 | Higher processing costs, risk of account closure |

Table 3: Common Causes of Payment Reversals and Preventive Measures

| Cause | Description | Preventive Measure |

|---|---|---|

| Product Unavailability | Items out of stock leading to order cancellation or refund. | Real-time inventory management to prevent overselling. |

| Merchant Errors | Incorrect pricing or duplicate charges. | Double-check transaction details before processing. |

| Buyer Dissatisfaction | Customer unhappy with product or service. | Offer clear product descriptions and excellent customer service. |

| Fraudulent Activities | Transactions initiated by unauthorized users. | Implement fraud detection systems and secure payment gateways. |

Conclusion

Payment reversals are a reality in business, but understanding their types, causes, and impacts helps in managing them effectively. By adopting best practices such as using clear billing descriptors, submitting transactions promptly, and leveraging advanced payment technologies, businesses can minimize reversals and protect their financial and reputational well-being.