Accrual accounting records financial transactions when they are earned or incurred, regardless of when the cash is received or paid. This method, required by Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), is crucial for companies, especially those with revenues exceeding $25 million.

This guide covers the core aspects of accrual accounting, its differences from cash accounting, and why it matters for businesses.

Introduction

Accrual accounting provides a clear view of a company’s financial health by recording revenue when it’s earned and expenses when they are incurred, not when money changes hands. This approach is mandatory for larger businesses and is a preferred method for accurate financial reporting.

In this article, we’ll explore the key principles of accrual accounting, examples of its application, and how it differs from cash accounting.

Accrual Accounting vs. Cash Accounting

Accrual and cash accounting differ in when transactions are recorded.

- Cash Accounting: Records transactions when cash is received or paid.

- Accrual Accounting: Records transactions when they are earned or incurred, regardless of payment.

Table 1: Accrual vs. Cash Accounting

| Aspect | Cash Accounting | Accrual Accounting |

|---|---|---|

| Revenue Recognition | When cash is received | When revenue is earned |

| Expense Recognition | When cash is paid | When expense is incurred |

| Financial Accuracy | Simplified | More accurate |

| GAAP Compliance | No | Yes |

In cash accounting, if a business provides services in March but is paid in April, the revenue is recorded in April. Under accrual accounting, revenue is recorded in March, when the service is delivered. This difference matters for businesses handling credit or long-term contracts. Companies earning over $25 million annually or holding inventory must use accrual accounting, per IRS regulations.

Core Principles of Accrual Accounting

1. The Matching Principle

The matching principle ensures expenses are recorded in the same period as the revenues they generate. This principle reflects true financial performance and prevents misleading financial statements.

For example, if a company incurs an expense in December to generate revenue in January, the expense must be recorded in December.

2. Revenue Recognition

Revenue is recognized when earned, not when cash is received. This principle ensures that financial reports accurately represent economic activity, as defined by the Financial Accounting Standards Board (FASB).

Example: A software company that delivers a product in Q1 but is paid in Q2 will record the revenue in Q1.

3. Adjusting Entries: Accruals and Deferrals

Accrual accounting requires adjusting entries to align revenue and expenses within the correct periods. These entries include:

- Accrued Revenue: Revenue earned but not yet received.

- Accrued Expenses: Expenses incurred but not yet paid.

- Deferred Revenue: Payment received for services not yet provided.

- Prepaid Expenses: Payment made for future goods or services.

These adjustments ensure that financial statements accurately reflect business activities.

Examples of Accrual Accounting in Business

Accrual accounting is essential for businesses offering credit or managing long-term projects. Below are practical examples:

1. Construction Industry

A construction company might take six months to complete a project. Under accrual accounting, the company records revenue as the work progresses, rather than when final payment is received.

2. Consulting Services

A consulting firm providing services over several months records revenue in the month services are delivered, not when the client pays.

3. E-Commerce Business

An e-commerce business that ships products before receiving payment must recognize revenue when the products are shipped, not when payment arrives.

Table 2: Accrual Accounting Adjusting Entries

| Type of Entry | Example Scenario | Adjusting Entry |

|---|---|---|

| Accrued Revenue | Consulting services provided, payment pending | Debit Accounts Receivable, Credit Revenue |

| Accrued Expenses | Supplies received, payment due next month | Debit Expense, Credit Accounts Payable |

| Deferred Revenue | Subscription service, payment received before delivery | Debit Cash, Credit Deferred Revenue |

| Prepaid Expenses | Annual software subscription paid upfront | Debit Prepaid Expenses, Credit Cash |

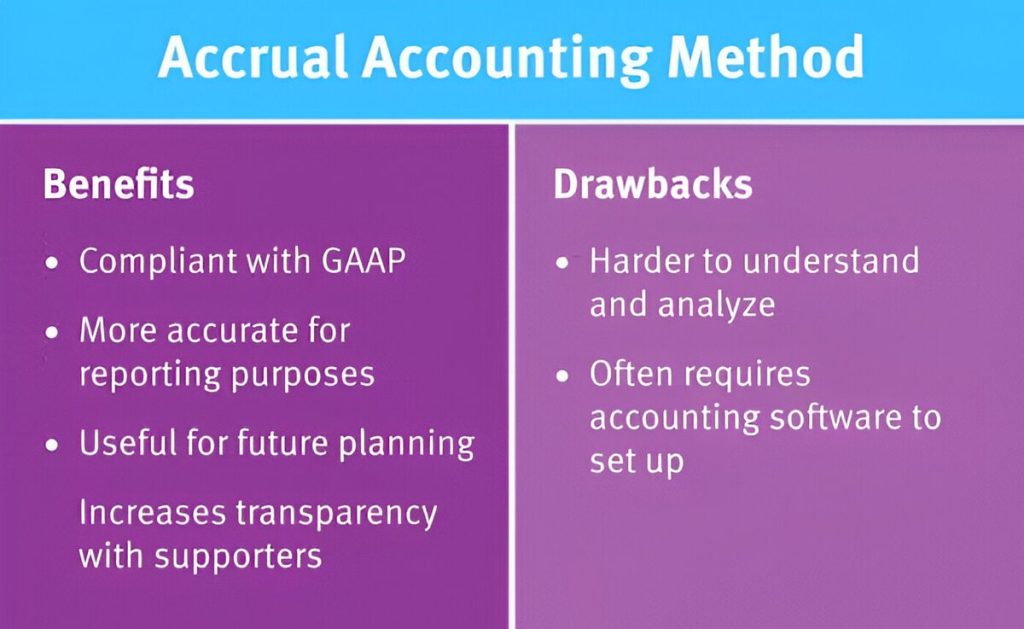

Benefits and Drawbacks of Accrual Accounting

Benefits

- Accurate Financial Reporting: Accrual accounting provides a more accurate picture of a company’s finances by matching revenue with the expenses used to generate it. This enables better decision-making and financial planning.

- GAAP Compliance: Accrual accounting is required for companies with more than $25 million in annual revenue to comply with GAAP, ensuring transparency and consistency in financial reports.

- Enhanced Cash Flow Management: Accrual accounting enables businesses to manage future cash flows more effectively by anticipating revenue and expenses.

Drawbacks

- Complexity: Accrual accounting is more complex than cash accounting, requiring detailed tracking of accounts receivable, accounts payable, and accruals.

- Tax Timing Issues: Businesses may end up paying taxes on income they haven’t yet received, which can strain cash flow.

When to Use Accrual Accounting

Businesses must use accrual accounting if they meet certain criteria, such as generating over $25 million in annual revenue or managing inventory. Even smaller businesses may benefit from accrual accounting if they:

- Extend credit to customers.

- Have long-term projects.

- Seek external investment.

The decision to use accrual accounting is typically based on the business’s complexity and growth.

Chargeback Prevention and Merchanto.org

Managing payments efficiently is essential for every business, and preventing chargebacks is critical. Chargebacks can harm cash flow and customer relations. Businesses using accrual accounting often face delayed payment issues, which can increase the likelihood of disputes and chargebacks.

A trusted payment partner can make all the difference. Merchanto.org, a partner of Visa and MasterCard in chargeback prevention, provides tools that help businesses minimize chargebacks and manage payment disputes more effectively. Their system proactively identifies potential chargebacks and prevents them before they occur. To explore how they can help streamline your payment process, visit Merchanto.org.

Practical Applications and Data

Let’s dive deeper into how accrual accounting improves financial reporting. The table below highlights scenarios where accrual accounting provides better insights than cash accounting.

Table 3: Accrual Accounting Impact on Financial Reporting

| Scenario | Cash Accounting Impact | Accrual Accounting Impact |

|---|---|---|

| Service Provided, Payment Later | No revenue recorded until payment received | Revenue recorded when service is provided |

| Expense Incurred, Payment Deferred | No expense recorded until payment made | Expense recorded when incurred |

| Prepaid Expenses (e.g., insurance) | No expenses recorded upfront | Expense spread over relevant periods |

| Subscription Services, Payment Upfront | Revenue recorded when cash received | Revenue spread over service period |

Accrual accounting ensures that financial reports provide a complete picture of a business’s financial situation, helping management make informed decisions.

Accrual Accounting Examples by Industry

Accrual accounting is used across industries for financial transparency and compliance with reporting standards. Below are some industry-specific applications:

1. Construction Industry

In construction, companies work on long-term projects and often face delayed payments. Using accrual accounting, revenue is recognized as work progresses, aligning with the actual work completed rather than waiting for final payment.

2. E-Commerce

E-commerce companies often deal with deferred payments from customers. With accrual accounting, they can recognize revenue at the time goods are shipped, ensuring that their financial reports accurately reflect sales activity.

3. Software-as-a-Service (SaaS)

SaaS companies often receive payments upfront for services rendered over several months or years. Accrual accounting allows them to spread this revenue over the service period, providing a clearer view of profitability.

Table 4: Accrual Accounting in Different Industries

| Industry | Key Revenue Recognition Event | Accrual Accounting Impact |

|---|---|---|

| Construction | Progress billing during a project | Revenue recognized as project milestones are met |

| E-Commerce | Goods shipped before payment is received | Revenue recorded when goods are shipped |

| SaaS | Subscription service for 12 months, paid upfront | Revenue spread over 12 months |

The Role of Accrual Accounting in Financial Planning

Accrual accounting provides businesses with better tools for long-term financial planning. By recognizing future expenses and revenues, companies can plan for upcoming obligations and better manage cash flow.

Businesses that rely on credit, such as wholesalers or distributors, benefit particularly from accrual accounting. By tracking receivables and payables, these companies can anticipate cash inflows and outflows, improving financial stability.

Table 5: Financial Planning Using Accrual Accounting

| Financial Activity | Accrual Accounting Method | Cash Accounting Method |

|---|---|---|

| Budgeting | Future revenue and expenses considered | Only current cash flows considered |

| Cash Flow Management | Future payables and receivables accounted for | Only actual cash transactions counted |

| Tax Planning | Taxes calculated based on earned income | Taxes calculated on cash received |

Conclusion

Accrual accounting is a vital method for businesses to ensure accurate financial reporting, especially for those handling credit, managing long-term contracts, or aiming for compliance with GAAP. It provides a better picture of a company’s true financial health by matching revenue with the related expenses.

This guide provides a thorough understanding of accrual accounting, its benefits, and its role in modern business finance. By implementing these practices, businesses can ensure financial transparency and accuracy in their reporting.