What is a Card-Present Transaction?

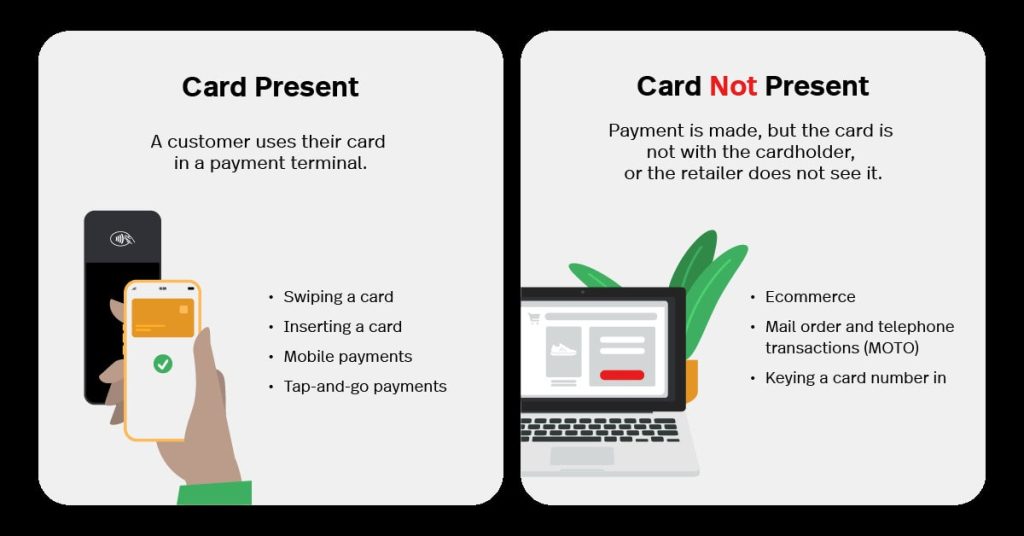

A card-present (CP) transaction takes place when a customer physically provides their payment card at a terminal. These transactions typically happen in brick-and-mortar stores, using a point-of-sale (POS) system where the card is swiped, inserted (EMV chip), or tapped (NFC). CP transactions ensure real-time verification of card data, making them a cornerstone of retail payments.

According to Mastercard, over 80% of in-store payments are now conducted using chip cards or contactless methods. This secure, efficient method of payment significantly reduces the risk of fraud and operational delays.

How Card-Present Transactions Work

In a CP transaction, the following steps typically occur:

- Card interaction: The card is either swiped, inserted, or tapped at the POS terminal.

- Data capture: The terminal captures the card data via magnetic stripe, EMV chip, or NFC technology.

- Authorization: The payment processor verifies the transaction, confirming it with the issuing bank.

- Verification: The cardholder may be required to enter a PIN or sign for added security.

Each method of processing a CP transaction provides a different level of security. For example, EMV chips are designed to prevent fraud by using encrypted data unique to each transaction, and NFC-based systems like Apple Pay ensure secure transmission via tokenization. These innovations have made CP transactions a preferred option for physical retail.

Common Methods of Card-Present Transactions

| Method | Technology Used | Key Feature |

|---|---|---|

| Magnetic Stripe | Magnetic stripe | Standard swipe transactions |

| EMV Chip | Embedded chip | Secure encryption and PIN |

| Contactless (NFC) | Near Field Comm. | Tap-to-pay systems |

| Mobile Wallets | NFC | Phone-based payments |

Advantages of Card-Present Transactions

- Enhanced Security: CP transactions are inherently more secure. Visa and Mastercard report that fraud rates for CP transactions are less than 0.01%, far lower than for card-not-present (CNP) transactions, which carry a higher risk due to the lack of physical card verification.

- Lower Transaction Costs: Payment processors such as Stripe and Checkout.com typically charge lower fees for CP transactions due to their reduced risk of fraud. CP fees range from 1.50% to 2.50%, while CNP fees can reach 3.50%. This reduction in processing costs can make a significant difference for businesses handling large volumes of transactions.

- Instant Payment Confirmation: CP transactions process in real-time, meaning funds are immediately transferred, which allows businesses to offer fast, reliable service to customers without delays. This system is essential for maintaining operational efficiency in retail environments.

- Reduced Chargeback Liability: In most CP transactions, liability for chargebacks due to fraud is shifted to the card issuer, provided that the merchant uses an EMV-compliant terminal. This reduces the financial burden on the merchant in cases of fraudulent activity.

Table 1: Transaction Fees Comparison: CP vs. CNP

| Transaction Type | Fee Range (%) | Chargeback Risk |

|---|---|---|

| Card-Present (CP) | 1.50% – 2.50% | Low |

| Card-Not-Present (CNP) | 1.80% – 3.50% | High |

Challenges of Card-Present Transactions

- Hardware Costs: CP transactions require physical equipment such as POS terminals, EMV chip readers, and NFC systems. The upfront cost of setting up these systems can be a barrier for small businesses. Additionally, these devices need maintenance, which adds to operational expenses.

- In-Person Requirement: CP transactions depend on the customer being physically present. This limits the reach of businesses that rely exclusively on in-store sales, especially as eCommerce continues to grow.

- EMV Liability: Since the EMV liability shift in 2015, merchants without EMV-compatible terminals are responsible for any fraudulent transactions made with chip-enabled cards. About 50% of U.S. small businesses are still not EMV-compliant, increasing their exposure to fraud.

- Potential for Fraud via Skimming: Although CP transactions are generally secure, they are not immune to fraud. Devices like skimmers can capture data from a card’s magnetic stripe. However, this risk is greatly reduced with the use of EMV chips and NFC technology.

Comparing Card-Present and Card-Not-Present Transactions

CP transactions provide several advantages over CNP transactions, particularly in terms of security and cost. In CNP transactions—such as online purchases—there is no way to physically verify the cardholder or card, leading to increased fraud and chargeback rates.

Security

CP transactions are more secure than CNP transactions because the card is physically present, and the transaction is authenticated in real time. Visa and Mastercard report that CNP fraud can be 20 times higher than fraud associated with CP transactions. In CP transactions, the merchant can inspect the card, use EMV chips, and require PINs or signatures for additional security.

Processing Fees

The processing fees for CP transactions are typically 1.5% to 2.5%, while CNP fees range between 1.8% and 3.5%. The difference in fees is due to the increased risk of fraud in CNP transactions. This cost difference can significantly affect businesses with a high volume of transactions.

Table 2: Card-Present vs Card-Not-Present Fraud Rates

| Transaction Type | Fraud Rate (%) | Average Fee (%) |

|---|---|---|

| Card-Present (CP) | 0.01% | 1.50% – 2.50% |

| Card-Not-Present (CNP) | 0.20% | 1.80% – 3.50% |

Customer Experience

CP transactions also contribute to a smoother customer experience. Payment confirmation is immediate, and contactless methods such as tap-to-pay further expedite the process. These advancements reduce the friction customers experience at checkout, minimizing wait times.

Emerging Trends in Card-Present Transactions

Contactless Payments

The adoption of contactless payments surged during the COVID-19 pandemic, with Mastercard reporting a 150% increase in contactless transactions in 2021. Consumers are increasingly preferring tap-to-pay methods for their speed and ease of use. Mastercard predicts that by 2025, over 30% of in-person transactions globally will be contactless.

Mobile Wallets

Payments made through mobile wallets such as Apple Pay and Google Pay are also on the rise. These wallets use NFC technology to transmit card information securely, making them a convenient and secure option. By 2025, mobile wallets are expected to account for 40% of all in-store transactions, up from 20% today.

Table 3: Global Contactless Payment Growth Forecast (2020–2025)

| Year | Transaction Volume ($B) | Growth Rate (%) |

|---|---|---|

| 2020 | 4.5 | 25 |

| 2021 | 5.6 | 24 |

| 2022 | 7.0 | 22 |

| 2023 | 8.9 | 21 |

| 2025 | 11.5 | 29 |

What Should Businesses Do?

Businesses that operate primarily in physical locations should prioritize integrating EMV chip readers and NFC terminals to maintain security and provide a seamless checkout experience. Moreover, merchants can reduce chargebacks and disputes by partnering with organizations like Merchanto.org, an official Visa and Mastercard partner specializing in chargeback prevention. Merchanto.org helps businesses minimize disputes and fraud-related chargebacks, lowering operational costs. Learn more here.

Conclusion

Card-present transactions remain an essential part of in-store payments, offering increased security, lower fees, and immediate processing. With the growing adoption of contactless payments and mobile wallets, CP transactions are becoming faster and more secure. Businesses must stay updated on the latest payment technologies and compliance requirements to mitigate fraud and optimize costs.