How to Calculate and Maximize Your Chargeback Win Rate

Chargebacks are a routine challenge for online merchants, especially in card-not-present (CNP) transactions. Managing them effectively is key to minimizing financial losses. A crucial performance indicator for this is the chargeback win rate, which helps assess how successful a business is in fighting chargebacks. This article will outline how to calculate this rate, strategies for improving it, and data-driven insights to help you recover lost revenue.

What is a Chargeback Win Rate?

The chargeback win rate measures the percentage of chargebacks a merchant successfully disputes. The calculation is straightforward:

Chargeback Win Rate (%) = (Number of Won Chargebacks / Total Chargebacks Filed) × 100

For example, if a business faces 100 chargebacks and wins 25, its win rate is 25%.

This metric helps merchants gauge the success of their chargeback management. A low win rate could signal that a company needs to improve its dispute handling, documentation, or strategy.

Importance of an Accurate Chargeback Win Rate

An accurate chargeback win rate is crucial for understanding overall dispute management performance. Miscalculations can distort how well a business is protecting its revenue.

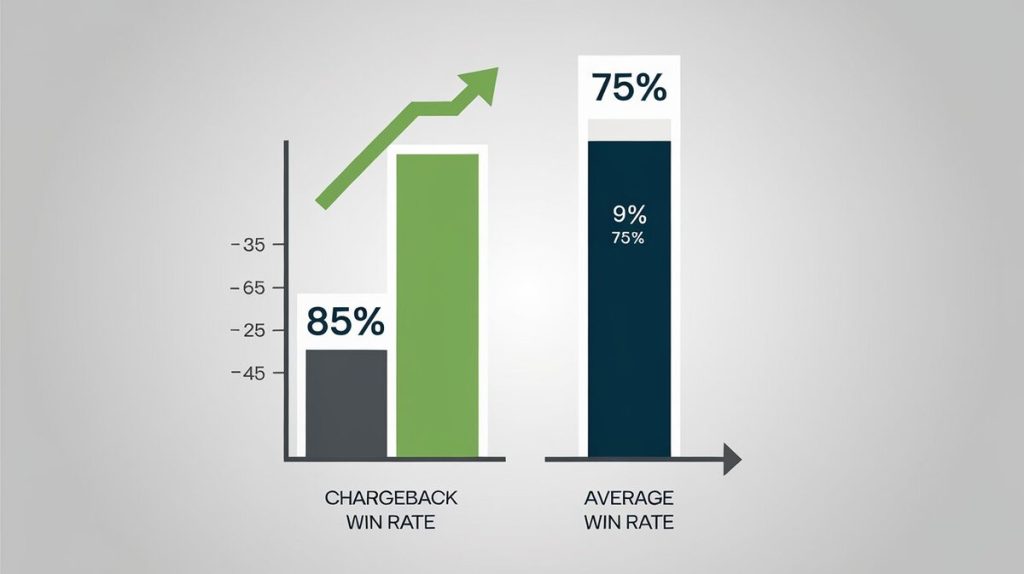

Mastercard’s data shows that 60-80% of chargebacks are related to friendly fraud. A proper win rate calculation provides a clear picture of how well the business is managing these disputes. Industry reports indicate that the average merchant win rate is 42%, meaning the majority of chargebacks are lost.

Chargeback Win Rate vs. Chargeback Ratio

It’s important to distinguish between the chargeback win rate and the chargeback ratio. Both are essential but measure different things:

- Chargeback Ratio: The total number of chargebacks as a percentage of total transactions.

- Chargeback Win Rate: The percentage of successful chargeback disputes.

Table 1: Chargeback Ratio vs. Chargeback Win Rate

| Metric | Definition |

|---|---|

| Chargeback Ratio | Total chargebacks / Total transactions × 100 |

| Chargeback Win Rate | Won chargebacks / Total chargebacks × 100 |

How to Calculate Your Chargeback Win Rate Correctly

Many merchants make the mistake of calculating their win rate based only on the chargebacks they contest. To get an accurate picture, it’s essential to include all chargebacks, contested or not. For example, if a merchant fights 40 out of 100 chargebacks and wins 20, the actual win rate is 20%, not 50%.

Table 2: Correct vs. Incorrect Chargeback Win Rate Calculations

| Month | Total Chargebacks | Contested Chargebacks | Won Chargebacks | Incorrect Win Rate (%) | Correct Win Rate (%) |

|---|---|---|---|---|---|

| June | 100 | 40 | 20 | 50 | 20 |

| July | 120 | 80 | 50 | 62.5 | 41.67 |

Strategies to Increase Chargeback Win Rate

- Understand Reason Codes

Each chargeback comes with a reason code, which outlines why it was initiated. Familiarizing yourself with these codes helps you better prepare responses. Mastercard reports that focusing on common fraud-related reason codes can increase your win rate by 25%. - Use Automated Chargeback Management Tools

Automated tools streamline the dispute process. Merchants can save time and reduce human error by using services like Merchanto.org, a Visa and Mastercard partner offering chargeback prevention tools. Learn more about Merchanto here. - Improve Documentation

Winning chargebacks often hinges on providing thorough documentation. Ensure that you collect:

- Proof of delivery

- Transaction records

- Customer communication logs

Braintree’s data shows that better documentation can improve win rates by 10-15%.

- Quick Response Times

Timing is critical in dispute management. Delayed responses lead to lost cases. According to Visa, merchants who respond within the recommended time frame win 30% more disputes. - Engage with Customers

Communicating proactively with customers can prevent chargebacks. Checkout.com reports a 20% reduction in chargebacks for merchants who maintain strong customer service.

Common Pitfalls in Chargeback Management

- Ignoring Friendly Fraud

Friendly fraud accounts for 60-80% of chargebacks, yet many merchants do not challenge these cases, assuming they cannot win. However, data from Stripe shows that fighting these disputes can improve win rates by 35%. - Poor Data Management

Without organized data, it’s hard to spot patterns or make informed decisions. AI-driven analytics can improve win rates by automating case preparation. - Inconsistent Efforts

Inconsistent responses to chargebacks reduce overall success. A clear, structured strategy for managing every dispute increases win rates by up to 30%.

Best Practices for Chargeback Management

- Monitor Trends: Regularly analyze your chargeback data to identify recurring issues. Focus on the most frequent reasons for chargebacks.

- Use Preventive Tools.

- Clear Communication: Ensure billing statements and product descriptions are clear to avoid disputes due to misunderstandings.

Table 3: Top Chargeback Management Tools

| Tool | Features | Estimated Impact on Win Rate (%) |

|---|---|---|

| Visa’s VCR System | Time management, automated dispute handling | +20 |

| Mastercard Dispute | Fraud detection, dispute analytics | +25 |

| Stripe Dispute System | Real-time alerts, simplified representment | +15 |

Real-World Example: Improving Win Rates

A mid-sized e-commerce business with a chargeback win rate of 22% was able to increase its win rate to 45% within six months. By improving documentation and responding faster, they successfully disputed more cases and reduced their overall financial losses.

Data-Driven Insights: The Importance of KPIs

Tracking KPIs like chargeback win rates is essential for long-term success. Merchants should not only focus on increasing their win rate but also reducing their chargeback ratio. Mastercard and Visa recommend keeping your chargeback ratio below 1% to avoid penalties and maintain good standing with payment processors.

Table 4: Chargeback Performance Benchmarks

| KPI | Industry Standard | Ideal Target |

|---|---|---|

| Chargeback Win Rate | 42% | 50%+ |

| Chargeback Ratio | <1% | <0.5% |

| Friendly Fraud Rate | 60-80% of disputes | Reduce by 20% |

Conclusion

Managing chargebacks effectively requires a consistent, data-driven approach. Your chargeback win rate is a key metric for assessing your success in protecting revenue. By implementing best practices—such as understanding reason codes, improving documentation, and leveraging services like Merchanto—you can improve your win rate and reduce your overall chargeback exposure.

Chargebacks will continue to be a challenge for merchants, but with the right strategies and tools in place, businesses can not only manage them but also thrive.

By following these strategies, merchants can improve their chargeback win rates, better manage disputes, and protect their bottom line.