Introduction

Chargebacks can seriously impact business profits, especially in e-commerce. A chargeback happens when a customer disputes a transaction, forcing the merchant to refund the sale. Chargebacks often arise from fraud or friendly fraud, where customers dispute legitimate charges.

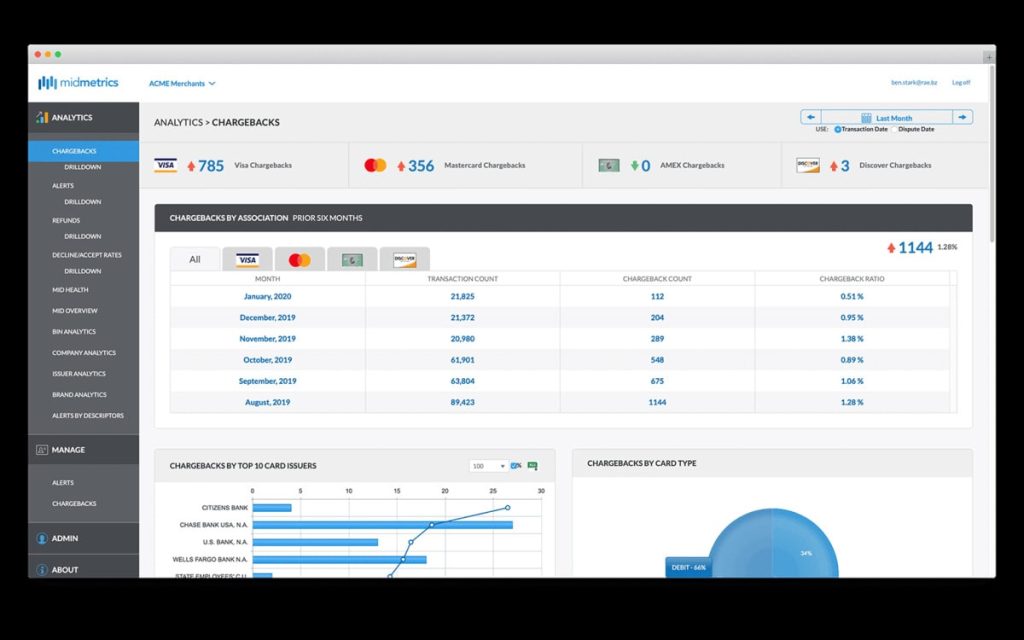

Businesses that exceed chargeback rates of 1% face penalties from card networks like Visa and Mastercard, including fines and the potential loss of processing rights. This has made chargeback prevention software a crucial tool for managing and reducing chargebacks efficiently.

In this article, we will explore the types of chargeback prevention software, key features, benefits, and data showing how these tools can safeguard businesses from financial damage.

Types of Chargeback Prevention Software

Chargeback prevention software comes in several forms, each suited to different business needs:

1. Self-Managed Solutions

Self-managed solutions are software-as-a-service (SaaS) platforms that allow businesses to manage their own chargeback processes. These tools automate dispute responses and provide analytics to help identify chargeback trends.

- Benefit: More control over the dispute process.

- Challenge: Requires dedicated resources for monitoring.

2. Fully Automated Solutions

Fully automated solutions use artificial intelligence (AI) to manage disputes without merchant intervention. These tools analyze transactions in real time, flagging and preventing suspicious activities.

- Benefit: Saves time and reduces costs.

- Challenge: Limited control over individual disputes.

3. Hybrid Models

Hybrid models combine automated tools with manual oversight, allowing businesses to handle high-risk transactions while relying on automation for routine disputes.

- Benefit: Flexibility to manage complex cases.

- Challenge: Requires some internal resources for manual review.

For businesses seeking a comprehensive solution, Merchanto.org—an official Visa and Mastercard partner—offers hybrid chargeback prevention software that integrates seamlessly with payment platforms. Learn more.

Key Features of Chargeback Prevention Software

Effective chargeback prevention tools provide several key features that help reduce chargebacks and protect revenue.

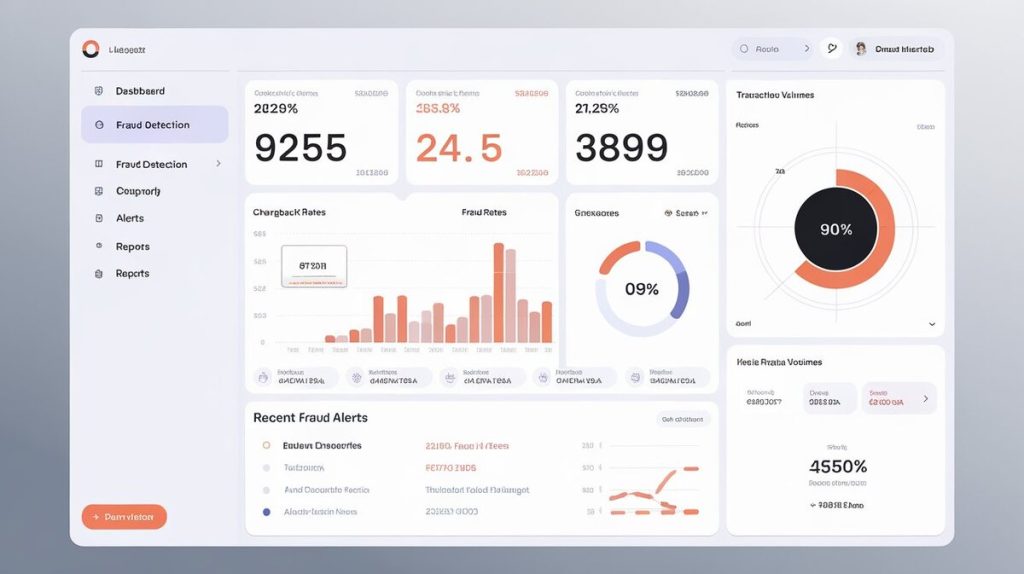

Real-Time Fraud Detection

Fraud detection is vital in preventing chargebacks. Fraud detection tools use several methods to identify potentially fraudulent transactions before they are processed. Common tools include:

- Address Verification Service (AVS): Compares the customer’s billing address with the address on file with the credit card company.

- Card Security Codes (CVV): Ensures the cardholder has the physical card by verifying the security code.

- 3-D Secure 2.0: Adds an extra layer of authentication for online transactions.

Analytics and Reporting

Analytics tools provide businesses with insights into the causes of chargebacks. They track transaction patterns, highlight potential problem areas, and offer solutions to minimize future chargebacks.

Automated Dispute Management

Chargeback prevention software automates the submission of representments (dispute responses) to banks, reducing the time spent handling disputes. Advanced solutions generate evidence automatically, improving win rates for merchants.

Table 1: Common Chargeback Causes and Prevention Strategies

| Cause | Prevention Strategy |

|---|---|

| Criminal Fraud | Implement multi-layer fraud detection systems such as AVS, CVV, and 3-D Secure. |

| Friendly Fraud | Improve transaction clarity and customer communication. |

| Merchant Error | Ensure clear return policies and avoid billing errors. |

Benefits of Chargeback Prevention Software

The financial impact of chargebacks can be significant. Businesses can lose up to 25% of revenue due to chargebacks. Chargeback prevention software helps reduce these losses by offering several key benefits:

Operational Efficiency

Manual chargeback management is slow and resource-intensive. Automated chargeback software reduces operational costs by 45%, saving employee hours and eliminating the repetitive tasks involved in dispute management.

Improved Win Rates

Using AI and machine learning, automated software improves a merchant’s win rate significantly. While manual win rates are around 12%, automated solutions have reported rates of up to 75%.

Fraud Prevention

Fraud detection systems within chargeback software help prevent fraudulent transactions before they become chargebacks. These systems analyze transaction details in real time and flag suspicious activity.

Protecting Business Reputation

Businesses with high chargeback rates face reputational risks with card networks. Keeping chargeback rates low protects a business from being added to Visa or Mastercard monitoring programs, which come with fines and penalties.

Table 2: Cost Comparison: Manual vs Automated Chargeback Management

| Category | Manual Process | Automated Process |

|---|---|---|

| Average Cost per Dispute | $50 – $75 | $10 – $20 |

| Win Rate | 12% | 75% |

| Employee Time | 2-4 hours per case | 0-30 minutes per case |

| Total Cost (per 1,000 disputes) | $50,000 – $75,000 | $10,000 – $20,000 |

Common Causes of Chargebacks

Understanding the main causes of chargebacks is essential to minimizing them. Below are three common causes and their solutions:

- Criminal Fraud: Criminals use stolen credit cards to make unauthorized purchases. Multi-layer fraud detection tools like fraud scoring and 3-D Secure can help detect fraudulent transactions.

- Friendly Fraud: Legitimate customers dispute transactions, often because they don’t recognize a charge. To reduce this, businesses need to provide clear billing descriptors and prompt customer communication.

- Merchant Error: Mistakes like incorrect billing, unclear policies, or delayed shipments can lead to chargebacks. Regular audits of business practices can help prevent these issues.

Table 3: Chargeback Prevention Tools by Type and Function

| Tool Type | Function | Usage Frequency |

|---|---|---|

| Address Verification (AVS) | Matches billing and registered addresses | 95% |

| Card Verification (CVV) | Confirms cardholder possesses the physical card | 88% |

| 3-D Secure | Adds authentication layer for online transactions | 70% |

| Fraud Scoring | Ranks transactions by fraud risk | 65% |

Best Practices for Chargeback Prevention

To effectively prevent chargebacks, businesses need to combine the right tools with sound practices. Here are key strategies:

- Multi-Layered Fraud Detection: Use several fraud detection tools simultaneously. This includes AVS, CVV, 3-D Secure, and fraud scoring to assess transaction risks.

- Monitor Chargeback Trends: Analytics tools in chargeback software provide insights into the root causes of disputes. Businesses should regularly review this data and take proactive steps to minimize risks.

- Optimize Customer Communication: Clear return and refund policies can help avoid misunderstandings that lead to friendly fraud chargebacks. Customer support teams should be well-trained to handle disputes before they escalate.

- Conduct Regular Audits: Merchants should review their processes regularly to identify potential weaknesses that could lead to chargebacks. Audits should focus on billing procedures, shipping policies, and customer service.

Conclusion

Chargeback prevention software is an essential tool for modern businesses, particularly those in e-commerce. By automating the dispute management process, businesses can save time, reduce costs, and improve dispute win rates. These tools also help prevent fraud and protect a business’s reputation with card networks like Visa and Mastercard.

By using the right software and following best practices, businesses can protect themselves from chargebacks, safeguard their reputation, and improve their bottom line.

This article is based on verified data from payment processors such as Visa, Mastercard, Stripe, and Checkout.com, ensuring that the information provided is reliable and actionable.