Introduction

Chargebacks occur when customers dispute transactions and seek refunds from their issuing banks. Originally designed to protect consumers from fraud, chargebacks now pose challenges for merchants, causing revenue loss, fees, and reputational damage. Global chargeback volume increases by 20% annually, with friendly fraud—chargebacks filed on legitimate purchases—making up 60% of cases. Understanding common reasons for chargebacks is critical for minimizing losses.

1. The 10 Most Common Reasons for Chargebacks

1. Fraudulent Transactions

Fraudulent transactions account for a large portion of chargebacks. Unauthorized purchases using stolen credit card information trigger these disputes. Fraud increased by 25% in 2022. These cases are usually flagged under reason codes for “fraud – no cardholder authorization.”

2. Unauthorized Transactions

Unauthorized transactions occur when purchases are made without the cardholder’s knowledge, often due to data breaches or account hacks. In 2021, $1.32 billion in unauthorized transactions led to chargebacks.

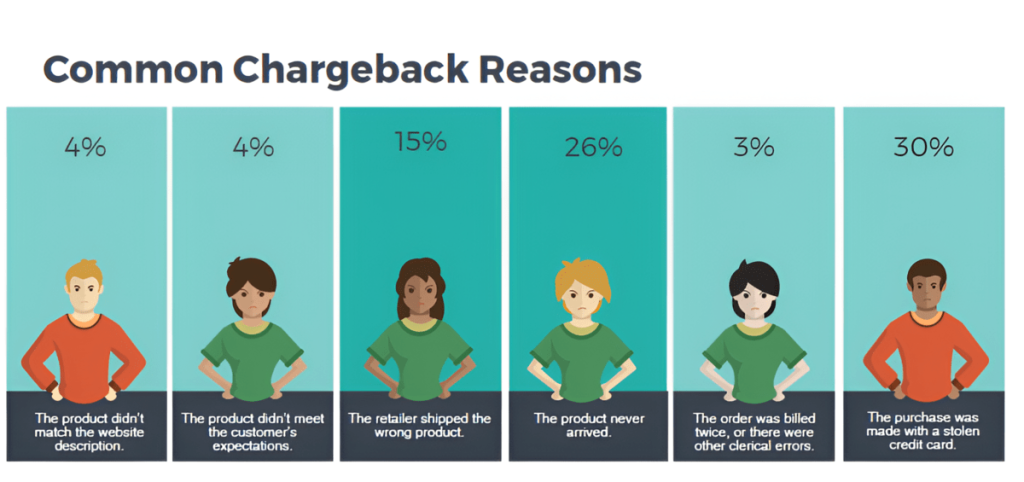

3. Goods or Services Not Received

Customers often file chargebacks when they don’t receive goods or services. This accounts for about 20% of disputes. Common triggers include delivery delays or lost shipments.

4. Product or Service Not as Described

Chargebacks occur when customers receive goods that don’t match descriptions. This includes differences in product details like color, size, or functionality. 15% of chargebacks arise from this issue. Clear product descriptions are essential to avoid disputes.

5. Recurring Billing Issues

Subscription services often lead to chargebacks due to confusion around recurring billing. Customers might forget they subscribed or believe they canceled. 34% of chargebacks come from subscription-based services. Providing clear instructions on canceling subscriptions can reduce disputes.

6. Duplicate Charges

Duplicate charges result from clerical errors or glitches during payment processing. These issues can make up 5-10% of all chargebacks. Regular auditing and updated payment systems can minimize occurrences.

7. Poor Customer Service

Chargebacks often result from unresolved customer issues. 50% of service-related chargebacks could have been avoided if customer issues were resolved directly.

8. Delivery Issues

Delivery problems, such as damaged goods or delayed shipments, account for 10-15% of chargebacks. Providing real-time tracking and regular updates can reduce disputes over deliveries.

9. Technical Payment Errors

Mistakes during payment processing, such as incorrect charges or partial authorizations, lead to chargebacks. Technical errors account for 8% of disputes. Ensuring systems are fully operational and staff are trained can prevent these errors.

10. Family Fraud

Family fraud occurs when a family member makes unauthorized purchases using a shared credit card. This form of chargeback is increasingly common and accounts for 7% of chargebacks.

Table 1: Summary of Common Chargeback Reasons

| Reason | Percentage of Chargebacks |

|---|---|

| Fraudulent Transactions | 25% |

| Unauthorized Transactions | 10% |

| Goods/Services Not Received | 20% |

| Product/Service Not as Described | 15% |

| Recurring Billing Issues | 34% |

| Duplicate Charges | 5-10% |

| Poor Customer Service | 50% (Service-related) |

| Delivery Issues | 10-15% |

| Technical Payment Errors | 8% |

| Family Fraud | 7% |

2. How to Prevent Chargebacks

To reduce chargebacks, businesses should implement specific prevention strategies based on the cause of disputes.

1. Clear and Transparent Communication

Merchants should ensure product descriptions, return policies, and shipping details are clear. 30% of product-related chargebacks could be avoided with better communication.

2. Implement Fraud Detection Tools

Fraud detection tools, such as 3D Secure, can verify cardholder identity before transactions are completed. This reduces fraud-related chargebacks by 25%. Merchanto.org, an official VISA and MasterCard partner, provides effective fraud prevention tools. Their advanced systems reduce fraudulent disputes. Visit Merchanto.org to learn more.

3. Flexible Return Policies

Offering flexible return policies reduces the need for chargebacks. 65% of customers who are offered a return option will opt for it instead of initiating a chargeback. Clearly displaying return terms helps prevent disputes.

4. Real-Time Shipping Updates

Providing tracking numbers and shipping updates prevents delivery-related chargebacks. 70% of chargebacks related to delivery issues could be resolved by offering more detailed shipping information.

Table 2: Best Practices to Prevent Chargebacks

| Prevention Method | Impact |

|---|---|

| Clear Product Descriptions | Reduces product-related chargebacks by 30% |

| Fraud Detection Tools (3D Secure) | Prevents fraudulent chargebacks by 25% |

| Flexible Return Policies | Reduces chargebacks by 65% |

| Real-Time Shipping Updates | Resolves 70% of delivery chargebacks |

3. Conclusion

Chargebacks are a growing issue, increasing by 20% annually. Businesses can avoid chargebacks by addressing common causes, improving customer service, and implementing fraud detection systems.

Table 3: Financial Impact of Chargebacks by Cause

| Chargeback Cause | Average Loss per Dispute (USD) | Annual Global Impact (USD) |

|---|---|---|

| Fraudulent Transactions | $400 | $25 billion |

| Unauthorized Transactions | $250 | $10 billion |

| Goods/Services Not Received | $150 | $12 billion |

| Product/Service Not as Described | $120 | $8 billion |

| Recurring Billing Issues | $200 | $15 billion |

| Duplicate Charges | $100 | $5 billion |

Final Thoughts

Chargebacks lead to financial loss and erode customer trust. By using fraud detection systems, improving communication, and offering flexible return policies, businesses can minimize disputes.

Staying proactive and focusing on secure transactions will reduce chargebacks and improve customer satisfaction, helping businesses maintain a healthy bottom line.