Chargebacks are a reality for businesses operating in the digital marketplace. Handling them effectively is crucial to reducing revenue loss and preventing future disputes. Improving your chargeback win rate should be a key focus for merchants to safeguard revenue and optimize payment operations. Here, we break down clear strategies, data-driven practices, and tools that can help you win more chargebacks.

What Is a Chargeback Win Rate?

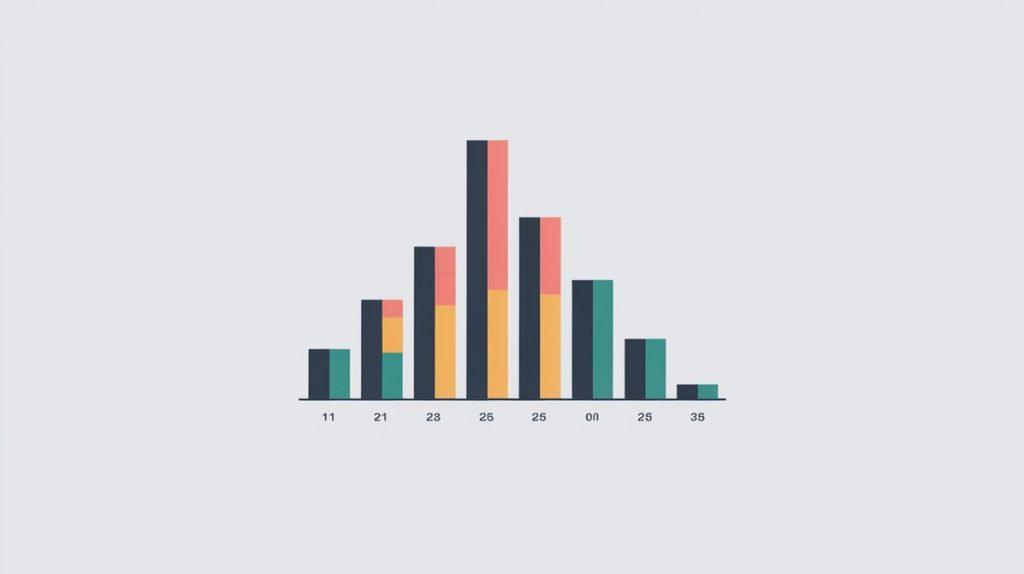

A chargeback win rate represents the percentage of disputes merchants win when contesting chargebacks. To calculate it, divide the number of won disputes by the total disputes fought:

- Win Rate = Chargebacks Won / (Chargebacks Won + Chargebacks Lost)

For example, if you win 20 of 50 chargebacks, your win rate is 40%. The average chargeback win rate for merchants is 21%, as reported by Mastercard, but with strategic actions, this figure can be significantly improved.

Chargeback Metrics to Track

In addition to the win rate, other metrics provide a more comprehensive view of how well you’re handling chargebacks:

- Net Recovery Rate: The total amount of revenue recovered from chargebacks as a percentage of total chargeback value.

- Dispute Ratio: Percentage of all transactions resulting in a chargeback. Keeping this ratio below 0.9% is critical to avoid penalties from payment networks like Visa and Mastercard.

Table 1: Chargeback Metrics Overview

| Metric | Description | Industry Standard |

|---|---|---|

| Chargeback Win Rate | Percentage of won disputes | 21% (average) |

| Net Recovery Rate | Percentage of disputed funds recovered | 12% (average) |

| Dispute Ratio | Percentage of transactions resulting in chargebacks | 0.7% (threshold) |

Why Improving Your Win Rate Matters

Boosting your chargeback win rate allows you to retain revenue and stay below chargeback thresholds. Visa’s documentation specifies that merchants who consistently cross a 1% dispute ratio risk severe penalties, including higher processing fees.

Key Strategies to Increase Chargeback Win Rate

1. Understand Chargeback Reason Codes

Chargebacks are categorized by reason codes, which describe why the transaction is disputed. Knowing these codes helps you tailor your response for better results.

- Common Visa and Mastercard Reason Codes:

- Visa Code 10.4: Fraud – Card Not Present

- Mastercard Code 4853: Goods or Services Not as Described

The most winnable chargebacks typically stem from misunderstandings, rather than outright fraud. Mastercard’s chargeback guide stresses the importance of recognizing these codes early to shape a strong defense.

2. Submit Complete Responses Early

Time is a critical factor in chargeback disputes. Merchants who submit complete responses well before the deadline have a higher chance of success. Always include:

- Proof of delivery

- Transaction details

- Terms of service

- Customer communications

Failure to provide these documents by the deadline means automatic loss. Mastercard recommends submitting responses at least three days before the deadline to allow time for revisions or resubmissions.

3. Provide Strong Evidence

Evidence is the backbone of any chargeback dispute. Research by Checkout.com shows that merchants who submit compelling evidence double their chances of winning. The type of evidence varies based on the transaction:

- Physical Goods:

- Proof of shipment

- Delivery confirmation

- Digital Goods:

- Login data

- Geolocation and IP addresses

- Services:

- Signed contracts or service agreements

Table 2: Evidence by Transaction Type

| Transaction Type | Key Evidence |

|---|---|

| Physical Goods | Delivery confirmation, signed receipts |

| Digital Goods | Login data, IP addresses, geolocation |

| Services | Signed contracts, communication records |

Filing the correct evidence relevant to the dispute can significantly increase the chances of winning the chargeback.

4. Implement Fraud Prevention Tools

Fraudulent chargebacks (true fraud) are tough to contest. However, using fraud prevention measures can reduce such chargebacks significantly. Implementing tools like AVS (Address Verification Service) and 3D Secure can cut down fraud-related disputes by as much as 20%, according to Braintree.

Merchants should also ensure PCI compliance to safeguard customer data. Visa mandates that businesses handle credit card data correctly under the PCI-DSS standards, which significantly reduces fraudulent transactions.

5. Organize Data Efficiently

Speed is key in fighting chargebacks. Efficient data organization allows you to quickly access customer profiles, transaction history, and billing information, which speeds up the response process. A survey by Stripe shows that well-organized data management systems improve dispute resolution times by up to 30%.

Recommendation: Use Merchanto for Chargeback Prevention

Merchanto.org, an official partner of Visa and Mastercard, offers chargeback prevention services that reduce fraud and enhance win rates. Merchants using their service report higher dispute success rates thanks to proactive fraud detection and prevention measures. Learn more at Merchanto.org.

Leveraging Technology to Increase Win Rates

AI-Driven Chargeback Management Systems

Artificial Intelligence (AI) is transforming the chargeback management process by automating dispute responses, analyzing patterns, and identifying fraud before it occurs. According to Checkout.com, AI-driven systems can reduce the volume of chargebacks by 15-20% through predictive analytics.

AI can also identify friendly fraud cases, helping merchants preemptively resolve issues without escalation to chargebacks.

Table 3: AI Benefits in Chargeback Management

| Tool | Benefit | Win Rate Improvement |

|---|---|---|

| AI Fraud Detection | Blocks suspicious transactions early | 30% |

| Automated Responses | Accelerates dispute submissions | 25% |

| Predictive Analytics | Identifies high-risk transactions | 15% |

Investing in AI tools not only saves time but also increases the overall success rate in disputes by ensuring faster and more accurate responses.

Preventing Chargebacks Before They Happen

Customer Communication and Engagement

Engaging with customers before a chargeback is filed can prevent disputes from escalating. Merchants who offer clear return policies, proactive customer support, and fast refunds reduce chargebacks by up to 40%, according to Visa. Open communication channels encourage customers to resolve issues directly rather than initiating chargebacks.

Pre-Dispute Solutions

Some disputes can be stopped before becoming full chargebacks through tools like chargeback alerts. These alerts notify merchants when a customer disputes a transaction, allowing them to resolve the issue by issuing a refund or clarifying the transaction.

Visa’s Rapid Dispute Resolution (RDR) system, for example, enables merchants to resolve disputes automatically before they escalate, reducing the number of chargebacks by 25-30%.

Maintain High-Quality Products and Services

Most chargebacks result from dissatisfaction with a product or service. According to Mastercard, 25% of chargebacks are linked to quality issues. Ensuring your products meet expectations and are accurately described minimizes the risk of disputes. Clear, transparent communication helps avoid customer frustration and unnecessary disputes.

Monitoring and Optimizing Key Metrics

Tracking the right performance indicators is essential for improving your chargeback win rate. Key metrics include:

- Chargeback Win Rate

- Net Recovery Rate

- Dispute-to-Transaction Ratio

By monitoring these KPIs regularly, merchants can identify areas for improvement and adjust strategies accordingly. Stripe suggests monitoring these metrics every 60 days to ensure that any necessary changes are made promptly.

Conclusion

Maximizing your chargeback win rate is crucial to protecting your business’s revenue. By understanding chargeback reason codes, submitting strong evidence on time, and utilizing fraud prevention tools, merchants can significantly improve their dispute success rates. Additionally, leveraging AI-driven systems and partnering with services will help streamline the chargeback process and prevent unnecessary losses.

Monitoring key metrics and keeping communication open with customers can prevent many disputes before they escalate. With the right strategies, tools, and systems in place, merchants can optimize their chargeback management and protect their bottom line.