Chargeback disputes are a significant concern for businesses, with merchants losing over $31 billion annually. A chargeback rebuttal letter allows merchants to challenge these disputes and recover lost revenue. In this guide, we’ll break down the essential parts of a chargeback rebuttal letter, best practices, and key evidence needed to reverse a chargeback. Additionally, we provide sample templates, data tables, and insights from authoritative sources like Visa, Mastercard, and Braintree.

1. What is a Chargeback Rebuttal Letter?

A chargeback occurs when a customer disputes a charge, forcing the bank to reverse the payment. A chargeback rebuttal letter is the merchant’s opportunity to contest the chargeback by presenting evidence. Given that over 80% of chargebacks result from friendly fraud, preparing an effective rebuttal is critical for minimizing revenue loss.

2. Key Components of a Chargeback Rebuttal Letter

A chargeback rebuttal letter should include all necessary information to support the merchant’s claim. The most important elements are:

- Merchant Information: Business name, Merchant Identification Number (MID), transaction date, chargeback reason code, and case number.

- Summary of the Dispute: Clearly explain the transaction and reason for disputing the chargeback.

- Supporting Evidence: Briefly list and attach relevant documents, such as proof of delivery or customer receipts.

- Compelling Argument: Explain why the chargeback is invalid using facts.

- Clear Request for Reversal: Explicitly ask for the reversal of the chargeback.

Table 1: Common Chargeback Reason Codes and Necessary Evidence

| Reason Code | Description | Required Evidence |

|---|---|---|

| 13.1 | Merchandise Not Received | Proof of delivery, signed receipts |

| 10.4 | Fraudulent Transaction | CVV match, IP logs, AVS match |

| 13.2 | Duplicate Processing | Single transaction proof |

| 13.3 | Item Not as Described | Product images, customer communication |

3. Writing an Effective Chargeback Rebuttal Letter

The tone and structure of the rebuttal letter impact its effectiveness. Keep it straightforward and factual. Focus on key points:

- Conciseness: Stick to the facts without unnecessary details.

- Clarity: Use bullet points to summarize the main evidence.

- Professionalism: Avoid emotional language. Keep the letter formal and focused on the dispute.

- Customization: Tailor each letter based on the specific chargeback reason code.

For example, if a chargeback is filed under “Merchandise Not Received,” include signed delivery receipts and tracking data.

Note: Merchanto.org, an official partner of Visa and Mastercard, offers specialized tools for chargeback prevention. Visit Merchanto.org for more information.

Table 2: Best Practices for Rebuttal Letters

| Best Practice | Reason |

|---|---|

| Submit Before Deadline | Missing deadlines means automatic loss of dispute. |

| Include All Required Documents | Missing documentation reduces your chances of success. |

| Use Clear Language | Clear points make it easier for banks to review the case. |

| Avoid Emotional Language | Emotional content detracts from factual arguments. |

4. Types of Compelling Evidence

The evidence you present in the rebuttal letter is critical. Here are key pieces of evidence that increase the likelihood of winning the dispute:

- Proof of Delivery: Shipping confirmation, signed delivery receipts, and tracking information.

- Transaction Details: IP logs, CVV match, AVS data, and any identity verification records.

- Customer Communication: Emails or messages where the customer confirms they received the product or service.

Table 3: Evidence Needed for Different Chargeback Types

| Chargeback Type | Required Evidence |

|---|---|

| Unauthorized Transaction (Fraud) | IP logs, CVV match, 3D Secure verification |

| Merchandise Not Delivered | Proof of shipment, signed delivery receipts |

| Service Not Provided | Service contracts, signed agreements, emails |

| Item Not as Described | Product images, customer feedback, return policies |

Fact: According to Visa, merchants who submit complete and compelling evidence have 42% higher success rates in reversing chargebacks.

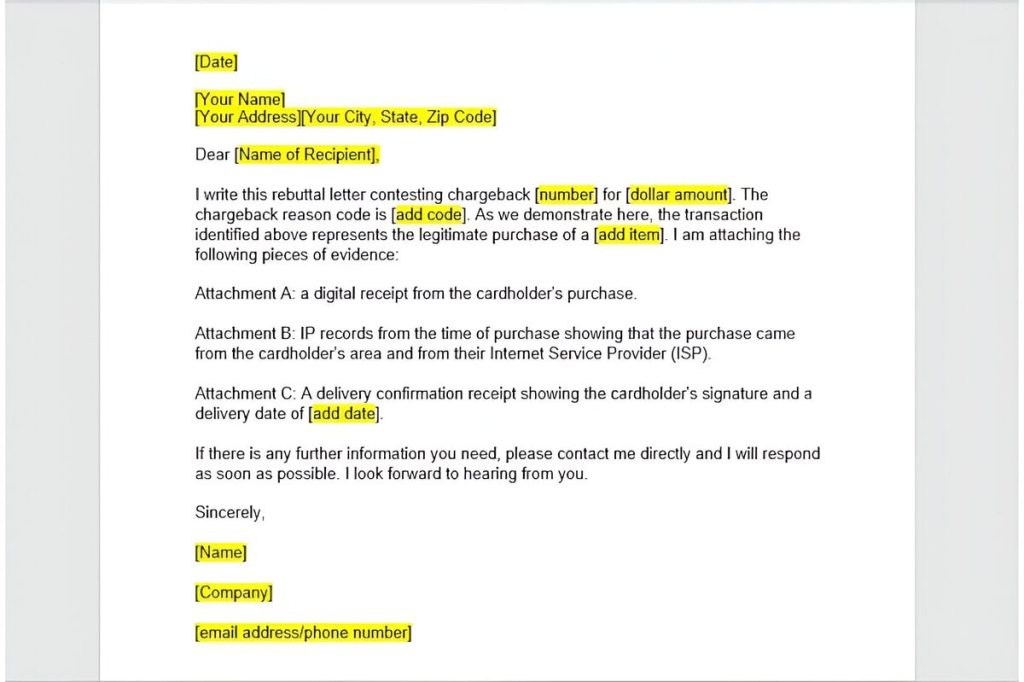

5. Chargeback Rebuttal Letter Template

Use the following template for your rebuttal letter, adjusting it based on the specific dispute:

[Merchant’s Name]

[Merchant’s Business Name]

[Merchant’s Address]

[Date]

[Bank’s Name]

[Chargeback Department]

[Bank’s Address]

RE: Chargeback Dispute for Transaction ID [Transaction ID], Chargeback Reason Code [Reason Code]

Dear Sir/Madam,

I am contesting chargeback [Number], relating to the transaction of [Product/Service] purchased by [Customer’s Name] on [Transaction Date] for [Amount]. I am including the following documents as evidence supporting the legitimacy of the transaction:

- Proof of delivery signed by the customer (Attachment A).

- A receipt showing the authorized purchase (Attachment B).

- IP logs verifying the transaction’s origin (Attachment C).

Based on this evidence, I request a reversal of the chargeback.

Sincerely,

[Merchant’s Name]

[Merchant’s Business Name]

This template provides a clear, factual structure for contesting chargebacks. Ensure all necessary documents are attached.

6. Avoiding Common Mistakes

To improve your chances of a successful chargeback dispute, avoid the following errors:

- Missing Submission Deadlines: Most banks and payment processors, like Visa and Mastercard, impose strict timelines. Missing the deadline results in automatic rejection.

- Incomplete Evidence: Omitting necessary documents, such as delivery confirmation or customer communication, weakens your argument.

- Overcomplicating the Rebuttal: Adding unnecessary details confuses the reviewer. Stick to essential facts.

7. When Not to Contest a Chargeback

Not every chargeback is worth contesting. Before submitting a rebuttal, evaluate whether the customer’s claim is valid. According to Mastercard guidelines, merchants should avoid disputing cases with legitimate claims. In situations where the product was damaged or a service was not delivered as promised, accepting the chargeback may be more beneficial.

Conclusion

Chargeback rebuttal letters are a crucial tool for recovering lost revenue. Following the best practices of submitting complete evidence, meeting deadlines, and maintaining a professional tone significantly increases the chances of success.

Key Takeaways:

- Always include identifying information and supporting evidence.

- Customize letters based on the specific chargeback reason.

- Focus on facts and maintain professionalism.

- Partner with services that help prevent chargebacks.

By following these guidelines, merchants can streamline the chargeback rebuttal process and improve their win rates.