The Automated Clearing House (ACH) network is essential for processing financial transactions in the United States, handling over $72 trillion in transactions in 2023. However, not all ACH transactions succeed. ACH return codes are used by financial institutions to identify and communicate issues with transactions. Knowing these codes helps businesses address problems quickly, minimizing financial risks.

This article outlines key ACH return codes, explains their significance, and offers practical advice on handling and preventing returns.

1. Introduction to ACH Return Codes

ACH return codes are alphanumeric codes that indicate the reason a transaction was returned. Each code addresses a specific issue, such as incorrect account details or insufficient funds. Businesses need to understand these codes to resolve issues effectively and avoid financial losses.

Key Points:

- ACH Network Volume (2023): Over 29.1 billion transactions processed.

- ACH Return Rate: Approximately 1-2% of all transactions are returned.

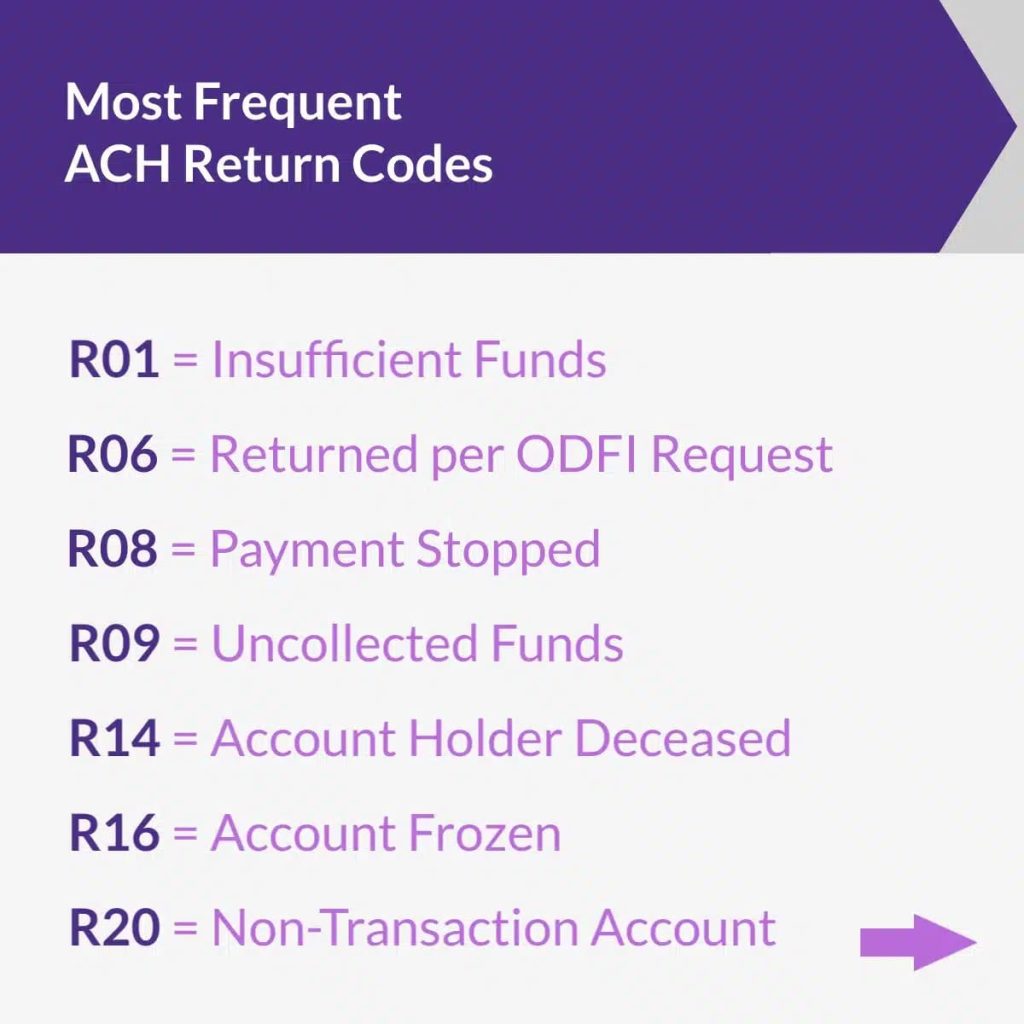

2. Common ACH Return Codes

Below are some common ACH return codes, their meanings, and recommended actions.

Table 1: Common ACH Return Codes

| Return Code | Description | Resolution Time Frame | Recommended Action |

|---|---|---|---|

| R01 | Insufficient Funds | 2 Banking Days | Retry after ensuring sufficient funds. |

| R02 | Account Closed | 2 Banking Days | Contact customer for new account details. |

| R03 | No Account/Unable to Locate Account | 2 Banking Days | Verify account information with the customer. |

| R29 | Corporate Customer Advises Not Authorized | 2 Banking Days | Obtain proper authorization from the customer. |

| R16 | Account Frozen/Entry Returned per OFAC | 2 Banking Days | Investigate with RDFI and take legal advice if needed. |

These codes cover frequent reasons for returns. For example, R01 (Insufficient Funds) occurs when the receiver’s account lacks the necessary funds. Businesses can mitigate this by verifying account balances before initiating transactions.

3. Full List of ACH Return Codes

The ACH network uses over 80 return codes, each addressing a specific situation. Here’s a comprehensive list, categorized by error type.

Table 2: Comprehensive ACH Return Codes (Selected Categories)

| Code | Error Type | Description | Category |

|---|---|---|---|

| R20 | Non-Transaction Account | Entry destined for a non-transaction account (e.g., savings). | Account Errors |

| R04 | Invalid Account Number | Account number structure is invalid. | Account Errors |

| R07 | Authorization Revoked by Customer | Customer revoked the transaction authorization. | Authorization Errors |

| R10 | Customer Advises Not Authorized | Receiver claims the transaction was unauthorized. | Authorization Errors |

| R13 | RDFI Not Qualified to Participate | RDFI is not authorized to participate in ACH. | Processing Errors |

| R26 | Mandatory Field Error | Missing or incorrect data in a mandatory field. | Processing Errors |

Understanding these codes allows businesses to quickly identify and rectify transaction issues.

4. Handling ACH Returns

Effectively managing ACH returns is crucial for maintaining operations and customer satisfaction. Here are best practices for handling returns:

- Immediate Action: Address the issue as soon as a return is identified.

- Customer Communication: Contact the customer to clarify and resolve the issue.

- Record-Keeping: Keep detailed records of all communications and actions taken.

For businesses looking to reduce financial risks, partnering with specialized services like Merchanto.org, a partner of VISA and MasterCard, can be valuable. They offer solutions for chargeback prevention, helping businesses navigate ACH transactions and reduce return occurrences. Learn more about their services here.

5. Preventing ACH Returns

Preventing ACH returns is more efficient than dealing with them after the fact. Here are strategies to reduce return occurrences:

- Account Verification: Use verification tools to ensure accurate account information before transactions.

- Clear Authorization: Ensure customers understand and authorize ACH transactions properly.

- Advanced Technology: Implement tools that flag potential issues before processing transactions.

Businesses that implement robust verification processes, like those offered by Checkout.com, can see a 25% reduction in ACH return rates.

Table 3: Best Practices for Reducing ACH Returns

| Strategy | Benefit | Example |

|---|---|---|

| Account Verification | Reduces errors related to invalid accounts. | Stripe.com provides verification APIs. |

| Clear Authorization | Prevents unauthorized transaction disputes. | Braintree.com offers secure payment processing. |

| Advanced Monitoring | Identifies and mitigates risks proactively. | Checkout.com utilizes AI for transaction monitoring. |

By adopting these strategies, businesses can reduce ACH returns and improve transaction success rates.

6. Conclusion

Understanding ACH return codes and managing them effectively is essential for any business involved in electronic payments. Familiarizing yourself with the most common return codes and implementing best practices can ensure smoother financial operations.

Partnering with experts provides additional protection. Their chargeback prevention solutions help minimize risks and optimize payment processes, giving businesses confidence in a complex financial environment.