Introduction

ABA routing numbers are nine-digit codes essential for identifying financial institutions in the United States during transactions. They ensure accurate processing of checks, wire transfers, and electronic payments. This article explains how ABA routing numbers work, where to find them, and their importance in various financial transactions.

What is an ABA Routing Number?

An ABA routing number, also known as a routing transit number (RTN), is a nine-digit code assigned to U.S. financial institutions by the American Bankers Association. These numbers are crucial for processing payments such as direct deposits, wire transfers, and checks. The number is composed of three key parts:

- Federal Reserve Routing Symbol: The first four digits indicate the bank’s location and Federal Reserve district.

- ABA Institution Identifier: The next four digits uniquely identify the bank within its district.

- Check Digit: The final digit validates the number.

Example: 011000138. The first two digits (“01”) represent the Federal Reserve Bank of Boston, the next four digits (“1000”) identify the institution, and the last digit (“8”) is the check digit.

History of ABA Routing Numbers

The ABA routing number system was established in 1910 by the American Bankers Association to streamline check sorting and delivery. As electronic banking evolved, the system adapted to support ACH payments and wire transfers. Despite the shift to digital transactions, ABA routing numbers remain critical in the U.S. financial system.

How ABA Routing Numbers Work

ABA routing numbers ensure accurate routing of transactions by identifying the appropriate financial institution. Each part of the number serves a distinct purpose:

Federal Reserve Routing Symbol

The first four digits represent the Federal Reserve district that processes the transaction. The Federal Reserve System is divided into 12 districts. Below is a table correlating the first two digits of the ABA routing number with the corresponding district.

| First Two Digits | Federal Reserve District | Major City |

|---|---|---|

| 01 | Boston | Boston, MA |

| 02 | New York | New York, NY |

| 03 | Philadelphia | Philadelphia, PA |

| 04 | Cleveland | Cleveland, OH |

| 05 | Richmond | Richmond, VA |

| 06 | Atlanta | Atlanta, GA |

| 07 | Chicago | Chicago, IL |

| 08 | St. Louis | St. Louis, MO |

| 09 | Minneapolis | Minneapolis, MN |

| 10 | Kansas City | Kansas City, MO |

| 11 | Dallas | Dallas, TX |

| 12 | San Francisco | San Francisco, CA |

ABA Institution Identifier

The next four digits identify the specific bank within its Federal Reserve district. This ensures that transactions reach the correct institution.

Check Digit

The last digit validates the ABA routing number. It is calculated using a formula based on the first eight digits, ensuring accuracy during transactions.

How to Find Your ABA Routing Number

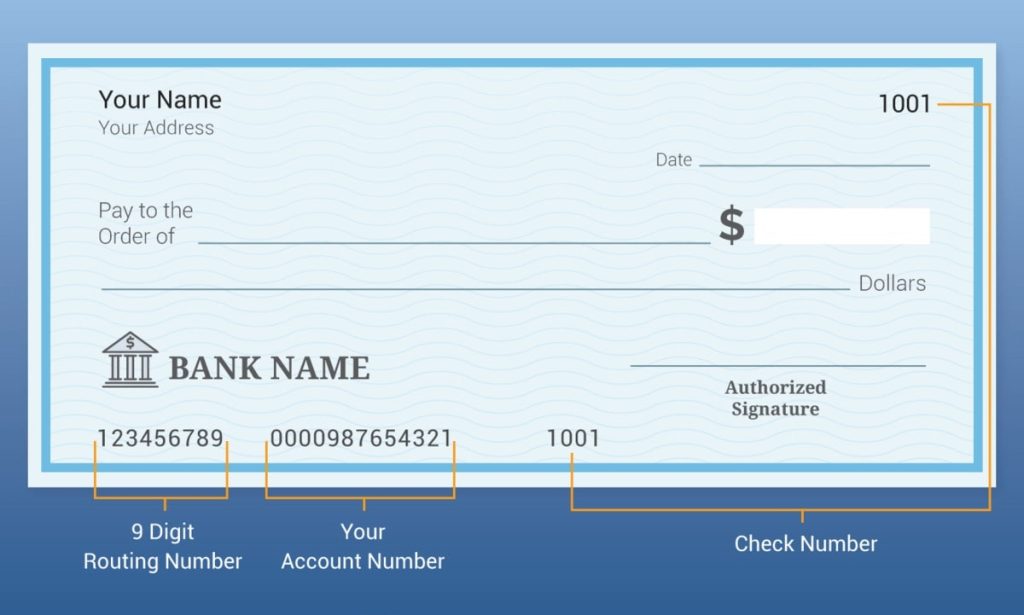

You can find your ABA routing number in several ways:

- Checks: The routing number is printed on the bottom left corner of checks.

- Bank Statements: Some banks include the routing number on monthly statements.

- Online Banking: Most banks provide routing numbers through their online banking platforms or mobile apps.

- Bank Websites: Many banks list routing numbers on their websites, especially for direct deposits and wire transfers.

- ABA Routing Number Lookup Tool: The American Bankers Association offers an online tool to locate routing numbers.

Example Table: ABA Routing Numbers for Major Banks

| Bank Name | State | ABA Routing Number | Transaction Type |

|---|---|---|---|

| Bank of America | California | 121000358 | Electronic Payments |

| Chase Bank | New York | 021000021 | Direct Deposit |

| Wells Fargo | Texas | 111900659 | Wire Transfers |

| PNC Bank | Maryland | 054000030 | ACH Payments |

| Citibank | Florida | 266086554 | Online Bill Payments |

Common Issues and FAQs

ABA routing numbers are straightforward but can cause confusion when different numbers are used for various transaction types. Here are some common issues:

1. Can a Bank Have Multiple Routing Numbers?

Yes, large banks often have multiple routing numbers based on the state or region where the account was opened. They may also use different routing numbers for different transactions, such as checks and wire transfers.

2. What Happens if I Use the Wrong Routing Number?

Using the wrong routing number can result in a failed transaction. It’s essential to verify the routing number before initiating a transaction.

3. How Are ABA Routing Numbers Different from SWIFT Codes?

ABA routing numbers are used for domestic transactions within the U.S., while SWIFT codes are used for international wire transfers.

Merchanto.org: Your Partner in Chargeback Prevention

In financial transactions, protecting your business from chargebacks is crucial. Merchanto.org is a trusted partner of VISA and MasterCard, specializing in chargeback prevention. Implementing their solutions can protect your business from fraudulent claims and ensure smooth financial operations. Visit their official website for more information.

How ABA Routing Numbers are Used in Different Transactions

ABA routing numbers are used in various financial transactions:

- Direct Deposits: Employers use ABA routing numbers to deposit paychecks directly into employees’ accounts.

- Wire Transfers: Banks use specific routing numbers for wire transfers, ensuring funds are sent to the correct bank.

- Check Processing: The routing number on checks directs the transaction to the appropriate bank.

- Automated Clearing House (ACH) Payments: ABA routing numbers are used for ACH payments, such as bill payments and online transfers.

Conclusion

ABA routing numbers are essential for processing transactions in the U.S. banking system. Understanding their structure and how to use them correctly helps prevent errors and ensures smooth transactions.