Chargebacks pose significant financial and operational risks for businesses. In this guide, we will outline essential chargeback management strategies focusing on prevention, response, and continuous improvement. By implementing these practices, businesses can reduce chargeback rates and protect revenue.

Introduction to Chargeback Management

A chargeback occurs when a cardholder disputes a transaction with their bank, leading to a reversal of funds. While designed to protect consumers, chargebacks can be abused and result in financial losses for businesses. Global chargebacks are expected to exceed $31 billion in 2024, with online transactions particularly vulnerable.

Chargebacks present several risks:

- Financial losses from reversed transactions and penalties.

- Operational costs related to dispute resolution.

- Increased fees and potential loss of payment processing rights if chargeback ratios exceed allowable limits.

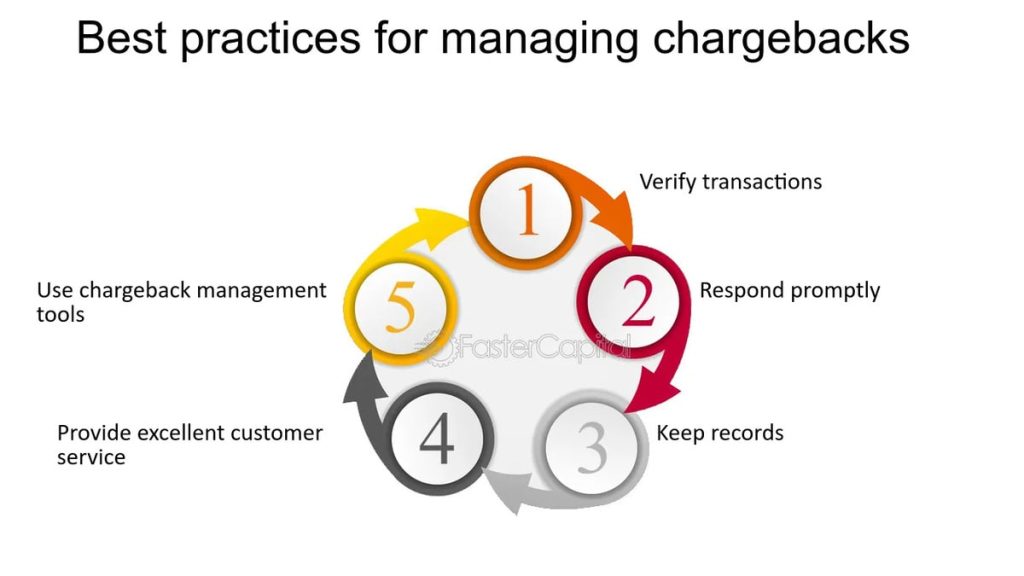

To manage chargebacks effectively, businesses must focus on prevention, maintaining strong customer communication, and using clear processes to handle disputes.

Types of Chargebacks

Understanding the three main types of chargebacks helps businesses address them with targeted solutions:

- True Fraud: Unauthorized transactions, often due to stolen credit card information.

- Solution: Use fraud detection tools like 3D Secure, multi-factor authentication, and device fingerprinting.

- Friendly Fraud: When customers dispute legitimate transactions, often due to misunderstanding or intent to defraud.

- Solution: Maintain clear transaction records and communicate proactively with customers.

- Merchant Error: Mistakes such as incorrect charges or shipping issues.

- Solution: Streamline billing processes, improve order tracking, and maintain clear return policies.

Chargeback Prevention Best Practices

Chargeback prevention should be the primary goal for any business. Preventing chargebacks is far less costly than resolving them.

Fraud Detection Tools

Fraud detection tools can reduce unauthorized transactions, a leading cause of chargebacks. VISA and Mastercard recommend the following tools:

- 3D Secure 2.0: This additional authentication step for online payments can reduce fraud rates by up to 70% (VISA).

- Device Fingerprinting: Identifies users based on their device, helping prevent unauthorized transactions.

- Address Verification System (AVS): Ensures that the billing address matches the card issuer’s data, reducing fraud by 65%.

| Fraud Detection Tool | Function | Effectiveness |

|---|---|---|

| 3D Secure 2.0 | Adds authentication for online payments | 70% reduction in fraud |

| Device Fingerprinting | Identifies users by device | 85% success rate |

| Address Verification (AVS) | Matches billing address with card issuer | 65% reduction in fraud |

Clear Customer Communication

Clear communication helps prevent disputes. Many chargebacks are filed due to misunderstandings or lack of information. The following practices can reduce disputes:

- Order Confirmations: Send detailed receipts with transaction data, product details, and expected delivery times.

- Shipping Updates: Regularly update customers on the status of their orders, especially with tracking information.

Tip: Businesses can partner with trusted chargeback prevention services. For example, Merchanto.org, a certified partner of VISA and Mastercard, offers solutions that help reduce chargeback rates by up to 40%. Learn more here.

Transparent Policies

Clear and accessible return and refund policies prevent many disputes. Ensure that:

- Return and refund policies are easily available on the website.

- Customers receive notifications of these policies during checkout and in confirmation emails.

Businesses should also include a clear cancellation policy, ensuring that customers understand the steps for canceling services or orders.

Handling Chargebacks: Representment and Response

Despite prevention efforts, chargebacks will still occur. A structured approach to representment—the process of disputing chargebacks—is essential for protecting revenue.

Proper Documentation

To win a chargeback dispute, you must provide clear, accurate documentation. Key documents include:

- Proof of delivery: Tracking numbers, delivery confirmations.

- Transaction logs: Records of the transaction, including payment data and timestamps.

- Customer communications: Email chains, support tickets that show efforts to resolve disputes.

| Document Type | Purpose | Examples |

|---|---|---|

| Proof of Delivery | Verifies the customer received the product | Tracking numbers, delivery confirmations |

| Transaction Logs | Provides payment and transaction details | Payment processor logs, timestamps |

| Customer Communications | Shows efforts to resolve issues before chargebacks | Emails, chat logs |

Quick Response

Responding quickly to chargebacks increases the chances of winning disputes. According to Mastercard, merchants who respond within the first 20 days are 55% more likely to win the dispute. Delayed responses may result in automatic losses.

Best Practices for Chargeback Response:

- Create response templates for common chargeback reasons.

- Assign a chargeback management team to handle disputes.

- Track deadlines to avoid missing response windows.

Continuous Monitoring and Improvement

Chargeback management requires constant monitoring and adjustment. Data analysis is key to understanding patterns and refining prevention strategies.

Data Analysis

Analyzing transaction data helps identify common causes of chargebacks and areas for improvement. Key metrics to monitor include:

- Chargeback Ratio: The percentage of chargebacks in relation to total transactions. VISA recommends maintaining a chargeback ratio below 1% to avoid penalties.

- Win Rate: The percentage of successfully contested chargebacks.

- Fraud Detection Accuracy: The percentage of fraudulent transactions blocked by your systems.

| Metric | Description | Recommended Threshold |

|---|---|---|

| Chargeback Ratio | Chargebacks as a percentage of total sales | Below 1% |

| Win Rate | Percentage of chargebacks successfully contested | 60% or higher |

| Fraud Detection Accuracy | Fraudulent transactions identified and blocked | 85% or higher |

Technology Integration

Integrating chargeback management software into your payment systems can automate and streamline many processes, including prevention, response, and data analysis. Key features of effective chargeback software include:

- Automated alerts when a chargeback is initiated, allowing for faster responses.

- Real-time fraud detection that flags suspicious transactions.

- Detailed reporting that tracks outcomes and provides insights for improvement.

Tip: Use APIs from your payment processors (e.g., Stripe, Braintree, Checkout.com) to pull transaction data and automate chargeback responses.

Tools for Chargeback Management

Businesses can choose between in-house solutions and third-party services to handle chargebacks. Each option has its advantages and disadvantages.

In-House Solutions

- Provide full control over the chargeback management process.

- Require significant investment in staff, training, and software.

- Best suited for businesses with high transaction volumes and specialized needs.

Third-Party Solutions

- Offer cost-effective solutions with access to advanced tools and expertise.

- Allow businesses to focus on core operations while leaving chargeback handling to experts.

- Suitable for small and medium-sized businesses that need efficient chargeback management.

| Solution Type | Advantages | Disadvantages |

|---|---|---|

| In-House Solutions | Full control, tailored to business needs | Requires high investment and resources |

| Third-Party Solutions | Access to advanced tools, lower operational costs | Less control over the chargeback process |

| Hybrid (Partial) | A mix of both control and outsourced efficiency | Requires coordination between internal and external teams |

Continuous Improvement

Chargeback management is an ongoing process. Businesses must continuously refine their practices by staying informed about new fraud tactics and regulatory updates.

Regular Reviews

Conduct regular reviews of chargeback data to identify areas for improvement. Analyze each dispute to find the root causes and adjust prevention strategies accordingly.

Fraud Prevention Updates

Fraud prevention tools and tactics should be updated regularly to address emerging threats. Keeping fraud detection systems up to date reduces the risk of new types of fraud leading to chargebacks.

Conclusion

Chargebacks are a persistent issue for businesses accepting card payments, but with the right strategies, they can be managed effectively. Prevention is the most efficient way to reduce chargebacks, but handling disputes swiftly and accurately when they arise is equally important.

By implementing best practices in fraud detection, customer communication, and data analysis, businesses can significantly lower chargeback rates. Leveraging chargeback management software and partnering with a certified provider can further streamline processes and protect your business from unnecessary losses.

This straightforward, data-driven approach ensures businesses can handle chargebacks effectively, saving both time and money.