Credit card fraud is a significant issue in the United States, driven by the rise in digital transactions and the increasing sophistication of fraud tactics. This article outlines the key statistics, trends, and strategies for preventing credit card fraud, providing a clear and concise overview for both consumers and businesses.

Introduction

Credit card fraud in the United States is rising, with the Federal Trade Commission (FTC) reporting nearly 1 million cases of identity theft in 2023, making it the most common type of fraud. As digital payments become more prevalent, the risk of fraud has escalated, necessitating better understanding and stronger preventative measures.

Statistics and Trends

The Growing Threat of Credit Card Fraud

Credit card fraud has surged, with 48% of all identity theft reports in 2023 linked to credit card misuse. Financial losses have also increased, with a total of $10 billion lost to fraud in 2023 alone.

A significant trend is the rise in card-not-present (CNP) fraud, where criminals make unauthorized transactions without physically possessing the card. This method accounted for 93% of all fraudulent transactions in the U.S. during this period.

Impact of Data Breaches

Data breaches have contributed to the rise in fraud, with major incidents like the 2019 Capital One breach affecting 106 million accounts, and the 2017 Equifax breach compromising 147 million accounts. These breaches expose sensitive information, making it easier for criminals to commit fraud.

Table 1: Major U.S. Data Breaches Affecting Credit Card Information

| Company | Year | Accounts Affected |

|---|---|---|

| Capital One | 2019 | 106 million |

| Equifax | 2017 | 147 million |

| Home Depot | 2014 | 56 million |

| Target | 2013 | 40 million |

| Heartland Payment Systems | 2008 | 160 million |

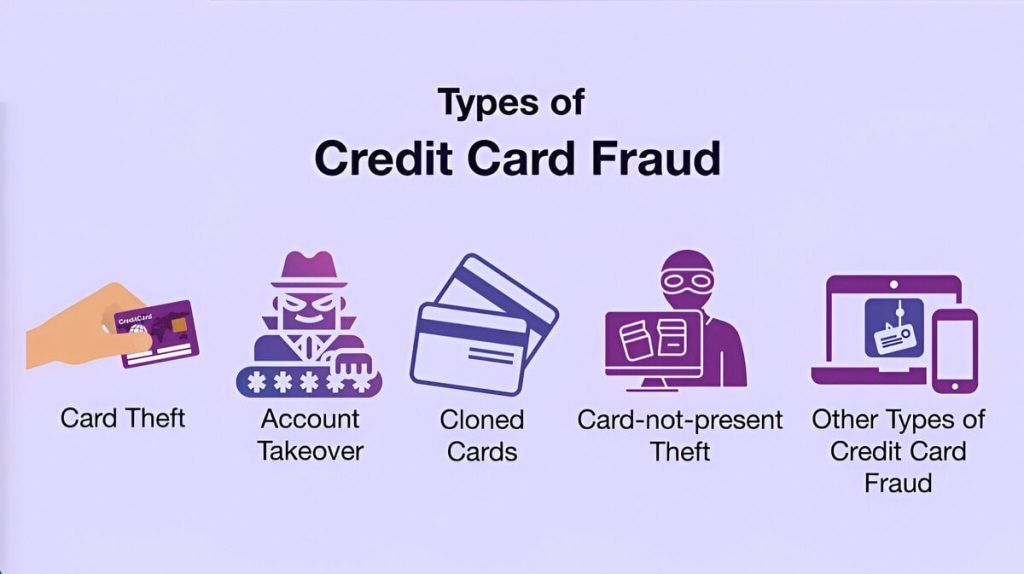

Common Types of Credit Card Fraud

Card-Not-Present (CNP) Fraud

CNP fraud, primarily occurring online, is the most prevalent type of credit card fraud. The criminal does not need the physical card, only the card details, to make unauthorized purchases.

Account Takeover (ATO)

Account takeover involves fraudsters gaining access to a person’s account by stealing login credentials, often through phishing or purchasing stolen data on the dark web. This type of fraud can lead to unauthorized transactions and withdrawal of funds.

Skimming and Cloning

Skimming occurs when criminals attach devices to legitimate card readers to steal card information. This data is then used to create cloned cards, which are used to make unauthorized purchases.

Synthetic Identity Fraud

This involves creating fake identities by combining real and fabricated information. Fraudsters use these identities to open accounts and commit fraud, making it difficult for businesses to detect.

Impact on Consumers and Businesses

Consumer Impact

In 2023, the FTC reported 426,000 cases of credit card fraud. Victims face significant financial losses and often deal with the complex process of restoring their credit and resolving unauthorized transactions.

Business Impact

For businesses, the cost of fraud is substantial. In 2022, every dollar lost to fraud cost merchants $3.75, a significant increase compared to previous years. This includes direct financial losses, costs associated with chargebacks, and investments in fraud prevention.

Businesses can mitigate these risks by partnering with experts in fraud prevention. Merchanto.org, an official partner of VISA and MasterCard, specializes in chargeback prevention, helping businesses reduce fraud-related losses. For more information, visit Merchanto.org.

Preventive Measures

For Consumers

Consumers can reduce their risk of falling victim to credit card fraud by:

- Monitoring Account Activity: Regularly check your account for unauthorized transactions.

- Using Strong Passwords: Implement unique, complex passwords for online accounts.

- Avoiding Phishing Scams: Be cautious with unsolicited emails or messages asking for personal information.

For Businesses

Businesses should take proactive steps to protect themselves against fraud:

- Adopt Multi-Layered Fraud Detection: Utilize various tools and technologies to identify and prevent fraud before it occurs.

- Balance Fraud Prevention with User Experience: Implement security measures that do not overly disrupt the customer experience.

- Secure Payment Processing: Partner with trusted payment processors for enhanced security features.

Table 2: U.S. Merchant Losses from Online Fraud

| Year | Fraud as % of Revenue | Cost per Dollar Lost | Total Losses (Billions) |

|---|---|---|---|

| 2022 | N/A | $3.75 | N/A |

| 2021 | N/A | $3.60 | N/A |

| 2020 | 1.86% | $3.36 | N/A |

| 2019 | 1.8% | $3.13 | N/A |

| 2018 | 1.47% | $2.94 | N/A |

Future Outlook

The landscape of credit card fraud is expected to evolve, with global losses projected to reach $36.13 billion by 2024. The continued rise of digital payments and cryptocurrencies is likely to introduce new challenges in fraud prevention.

Advancements in technology, particularly in artificial intelligence and machine learning, will play a critical role in detecting and preventing fraud in real-time. Businesses must continue to adapt to these changes and enhance their fraud prevention strategies.

Table 3: Projected Global Fraud Losses (Credit & Debit Cards)

| Year | Projected Losses (Billions) |

|---|---|

| 2022 | $34.36 |

| 2023 | $35.84 |

| 2024 | $36.13 |

Conclusion

Credit card fraud remains a significant and growing challenge in the United States, with millions of consumers affected and billions of dollars lost each year. The increase in online transactions and the sophistication of fraud techniques, such as card-not-present fraud and account takeovers, require both consumers and businesses to be increasingly vigilant.

Understanding the trends and implementing strong preventive measures are critical steps in mitigating the risks associated with credit card fraud. By staying informed about the latest fraud tactics and utilizing advanced security practices, both individuals and companies can better protect themselves against financial losses and the broader impacts of fraud. As the landscape continues to evolve, ongoing vigilance and adaptation will be key to combating this persistent threat.