Understanding the differences between chargebacks and refunds is crucial for any business handling electronic payments. While often confused, these terms have distinct meanings and implications for merchants and consumers. This article breaks down these concepts, focusing on their impact on businesses and how to manage them effectively.

Refund: What It Is and How It Works

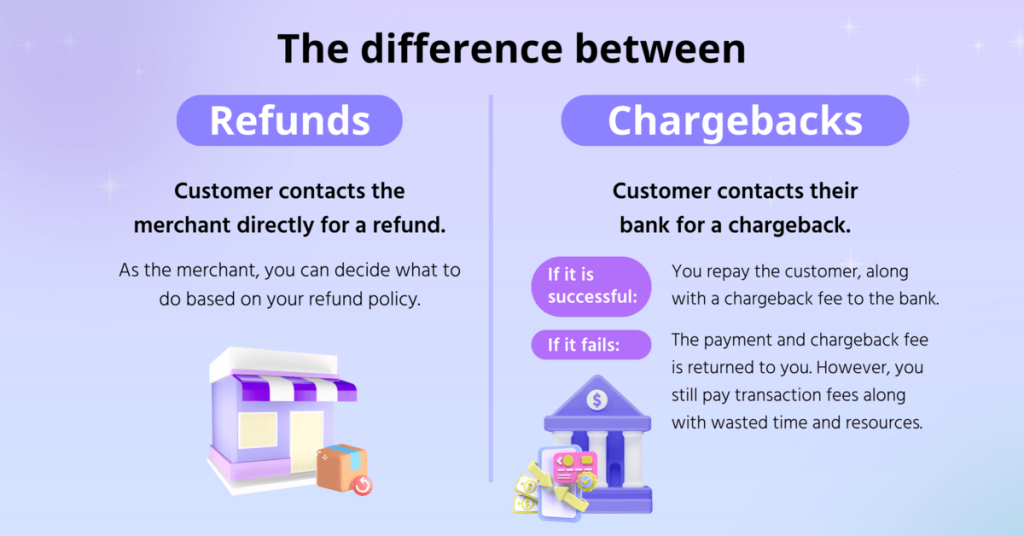

A refund is a merchant-initiated return of money to a customer, typically due to a product return, cancellation, or dissatisfaction with the purchase. The process involves the customer contacting the merchant directly to request a refund, which is then processed through the payment system.

Key Aspects of Refunds:

- Initiation: The customer contacts the merchant.

- Processing Time: Usually within 3-10 business days.

- Costs: Limited to the transaction fees.

- Control: The merchant handles the entire process.

- Customer Relationship: Refunds can maintain or improve customer loyalty if handled well.

Chargeback: What It Is and Its Implications

A chargeback occurs when a customer disputes a transaction with their bank, which then reverses the payment. Chargebacks were designed to protect consumers from fraud or errors but also create significant challenges for merchants.

Key Aspects of Chargebacks:

- Initiation: The customer contacts their bank, not the merchant.

- Processing Time: 30-90 days or longer.

- Costs: Fees range from $20 to $100 per chargeback, plus penalties if chargeback ratios are too high.

- Control: Limited merchant control; the outcome is largely in the hands of the bank.

- Customer Relationship: High chargeback rates can damage customer trust and business reputation.

Comparing Chargebacks and Refunds

Table 1: Key Differences Between Refunds and Chargebacks

| Aspect | Refund | Chargeback |

|---|---|---|

| Initiation | Customer contacts the merchant | Customer contacts the bank |

| Processing Time | 3-10 business days | 30-90 days or longer |

| Fees Involved | Minimal, usually just transaction fees | $20 to $100 per chargeback, plus potential penalties |

| Control | Merchant has full control | Limited control by the merchant |

| Customer Relationship | Can maintain or enhance loyalty | Often damages relationship |

| Financial Risk | Lower, controlled by the merchant | Higher, with potential penalties and lost revenue |

Business Impact of Chargebacks and Refunds

1. Financial Impact

Chargebacks impose a significant financial burden. According to data from Checkout.com, chargebacks cost merchants between $30 and $50 per case, excluding the potential loss of the product or service. Moreover, if a merchant’s chargeback ratio exceeds 0.9% to 1%, they risk penalties, increased processing fees, or even account termination.

2. Reputational Impact

Chargebacks can harm a merchant’s reputation. High chargeback ratios can lead to a merchant being classified as high-risk by payment processors like VISA and Mastercard. This classification can result in increased fees and fewer processing options.

3. Control Over Transactions

Refunds allow merchants to manage customer disputes directly, offering solutions like exchanges, store credits, or partial refunds. Chargebacks, however, are largely out of the merchant’s control once the bank gets involved.

Preventive Measures

1. Clear Refund Policies

Merchants should establish clear refund policies. A straightforward refund policy can reduce the likelihood of chargebacks by guiding customers to seek refunds instead.

2. Effective Customer Service

Strong customer service can prevent disputes from escalating to chargebacks. One-third of customers expect a response to inquiries within one hour. Quick responses can resolve issues before they reach the bank.

3. Fraud Prevention Tools

Implementing fraud detection systems is essential to minimize chargebacks. Tools like Address Verification Systems (AVS) and Card Verification Value (CVV) checks can identify suspicious transactions. Requiring customer accounts can also reduce fraudulent chargebacks by making purchases easier to track.

Detailed Comparison

Table 2: Costs and Timeframes for Refunds vs. Chargebacks

| Metric | Refund | Chargeback |

|---|---|---|

| Average Cost | $0 – $2 (transaction fees) | $20 – $100 per chargeback |

| Processing Time | 3-10 business days | 30-90 days or more |

| Control Over Process | High | Low |

| Impact on Customer Trust | Generally positive | Often negative |

Reducing Chargebacks and Promoting Refunds

1. Offer Refunds Promptly: Quick refunds prevent dissatisfaction from escalating to chargebacks.

2. Communicate Clearly: Ensure customers understand the refund process. Miscommunication often leads to unnecessary chargebacks.

3. Monitor Transactions: Use real-time fraud detection to identify and address suspicious activity before it results in a chargeback.

4. Partner with Experts: For businesses aiming to minimize chargebacks, consider partnering with specialists. Merchanto.org, an official partner of VISA and MasterCard, provides advanced chargeback prevention strategies. Learn more at Merchanto.org.

Tables with Key Data

Table 3: Chargeback vs. Refund Impacts on Business Operations

| Metric | Refund | Chargeback |

|---|---|---|

| Revenue Impact | Loss of product value only | Loss of product plus fees |

| Customer Satisfaction | Maintained or improved | Typically decreased |

| Processing Complexity | Simple, direct resolution | Complex, involving multiple parties |

| Risk of Account Termination | Low | High, if chargeback ratio exceeds 1% |

Conclusion

Understanding the distinction between chargebacks and refunds is essential for managing your business’s financial health. Refunds are generally less costly and easier to manage than chargebacks, making them the preferred method for resolving disputes. By implementing clear refund policies, enhancing customer service, and utilizing fraud prevention tools, merchants can significantly reduce the risk of chargebacks and their associated costs.

Effective management of chargebacks and refunds is crucial for maintaining a profitable and reputable business. In today’s market, staying proactive in these areas is not just advisable—it’s necessary.