Introduction

Chargebacks present a costly challenge for businesses. When customers dispute a transaction, the merchant not only loses the sale but also faces significant fees. Each chargeback can cost a business up to $3.75 per $1 lost, considering processing fees, fines, and operational costs. High chargeback rates can further result in fines or even the suspension of merchant accounts by payment processors like Visa and Mastercard.

This guide outlines the necessary steps to reduce chargeback rates, maintain a healthy business relationship with processors, and avoid costly penalties.

Understanding Chargebacks

Chargebacks happen when customers dispute a transaction, resulting in a forced refund by the payment processor. Common causes include:

- Fraudulent transactions: Unauthorized use of a credit card.

- Processing errors: Duplicate or incorrect charges.

- Product dissatisfaction: Customers who feel misled by the product description.

- Friendly fraud: Customers falsely claiming they didn’t authorize a purchase.

Chargeback thresholds set by Visa and Mastercard are strict: merchants must maintain a chargeback ratio below 1% to avoid penalties. A chargeback ratio is calculated as the number of chargebacks divided by the total number of transactions over a specific period. Exceeding this threshold can lead to fines, added scrutiny, or account termination.

Financial and Operational Impact of High Chargeback Rates

The financial hit from chargebacks is substantial:

- Direct losses: The transaction amount is reversed, and businesses are charged additional fees that can range from $15 to $100 per chargeback.

- Penalties: High-risk merchants can incur fines of up to $500 per month, depending on the processor.

- Operational strain: Managing chargebacks requires additional resources, from handling disputes to maintaining compliance.

Merchants classified as high-risk can also face account suspensions, making it difficult to continue accepting card payments. This damage extends to reputation as customers may view frequent chargebacks as a sign of poor business practices.

Chargeback Prevention Strategies

Preventing chargebacks requires a proactive approach. Below are strategies that can reduce chargeback occurrences and keep your business within acceptable chargeback ratio limits.

1. Fraud Detection Systems

Implementing fraud prevention tools, such as AI-powered detection systems, helps identify and block suspicious transactions. These systems scan for risk factors, such as unusual purchasing patterns or flagged payment methods.

Pro tip: Businesses should consider partnering with Merchanto.org, an official partner of Visa and Mastercard, for access to enhanced fraud prevention tools. Merchanto offers fraud detection systems that work seamlessly with existing payment processors. Learn more here.

2. Clear Return and Refund Policies

Clear communication about refund and return policies can prevent customers from initiating chargebacks. Ensure your policies are prominently displayed on your website and easy to understand.

3. Accurate Product Descriptions

Customers frequently file disputes when products don’t meet expectations. Ensure product descriptions and images are accurate to minimize misunderstandings.

4. Improving Customer Service

Proactively addressing customer complaints reduces the chances of disputes. Merchants should provide multiple communication channels and resolve issues quickly.

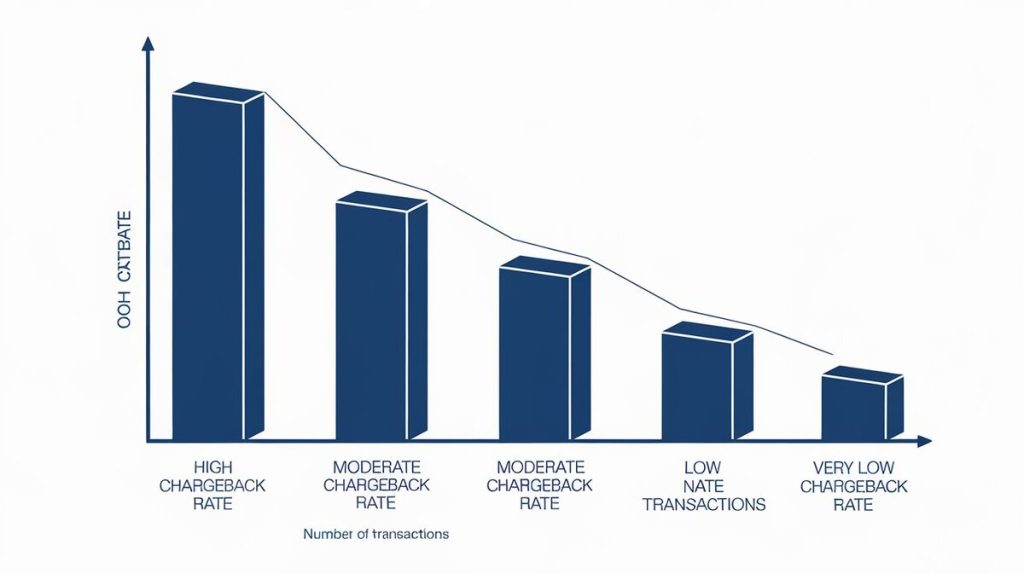

Tracking and Analyzing Chargeback Data

Monitoring your chargeback ratio is critical for staying within acceptable limits. The formula is straightforward: Chargeback ratio = (Number of chargebacks / Total transactions). For instance, if a business handles 1,000 transactions and has 10 chargebacks, its chargeback ratio is 1%, the threshold set by Visa and Mastercard.

| Merchant | Total Transactions | Chargebacks | Chargeback Ratio |

|---|---|---|---|

| Online Store A | 10,000 | 80 | 0.8% |

| Subscription Service B | 5,000 | 75 | 1.5% |

| Marketplace C | 20,000 | 100 | 0.5% |

Businesses must monitor this ratio regularly. Exceeding these limits results in penalties, increased fees, or account closure by payment processors.

Disputing Chargebacks Effectively

Even with the best prevention strategies, chargebacks can still occur. When they do, disputing them effectively is crucial to avoid financial losses.

1. Collect and Maintain Transaction Data

Merchants must keep detailed records of every transaction, including communication with the customer, delivery confirmation, and payment authorization records.

2. Respond to Disputes Promptly

Merchants should submit all evidence within the timeframes set by card networks, typically 30-60 days. Visa and Mastercard have strict deadlines for responding to chargebacks.

| Card Network | Dispute Response Time | Typical Chargeback Fee |

|---|---|---|

| Visa | 30-60 days | $15-$500 |

| Mastercard | 30-60 days | $15-$500 |

3. Analyze Chargeback Data

Tracking the reasons behind chargebacks helps identify trends. Analyzing common chargeback causes allows businesses to adjust their strategies, whether it’s revising product descriptions or enhancing fraud detection.

Using Tools to Manage Chargebacks

Managing chargebacks requires the right tools to reduce the time and cost involved. Automating the dispute process and improving visibility into chargeback data can help businesses stay ahead of the curve.

1. Automation Tools

Automation can significantly streamline the process of handling chargebacks. Many payment platforms offer tools that automatically gather and submit dispute evidence, minimizing the time required by merchants.

2. Real-Time Reporting

Platforms provide merchants with dashboards that allow them to monitor chargeback trends, dispute outcomes, and overall performance in real-time. These insights help merchants adjust their business practices to reduce future chargebacks.

3. Third-Party Integration

For businesses looking to optimize their chargeback management, integrating third-party services that specialize in chargeback prevention can be a game changer.

Chargeback Management Overview

| Tool | Benefit | Example Provider |

|---|---|---|

| Automated dispute management | Speeds up dispute resolution | Stripe, Braintree |

| Real-time reporting | Provides insights for prevention | Various payment platforms |

Key Metrics for Chargeback Management

When managing chargebacks, certain metrics are vital for tracking performance:

- Chargeback ratio: As mentioned, this tracks the percentage of chargebacks to total transactions. Keeping this below 1% is crucial.

- Net win rate: Measures the success of disputing chargebacks. Businesses should aim for a net win rate above 68%.

- Chargeback fees: Monitoring total chargeback fees can highlight inefficiencies and identify where prevention efforts should be strengthened.

Conclusion

Reducing chargebacks and keeping them within acceptable limits is crucial to maintaining strong relationships with payment processors like Visa and Mastercard. Preventive measures—fraud detection, clear policies, and fast customer service—are essential. When chargebacks do occur, businesses need to respond quickly and effectively, backed by strong documentation and automation tools.