Introduction

With eCommerce growth, integrating a payment gateway into your website is essential. In 2023, global online retail sales reached $4.9 trillion, with projections to exceed $7.4 trillion by 2025. This growth emphasizes the importance of a secure payment process to maintain customer trust and drive sales.

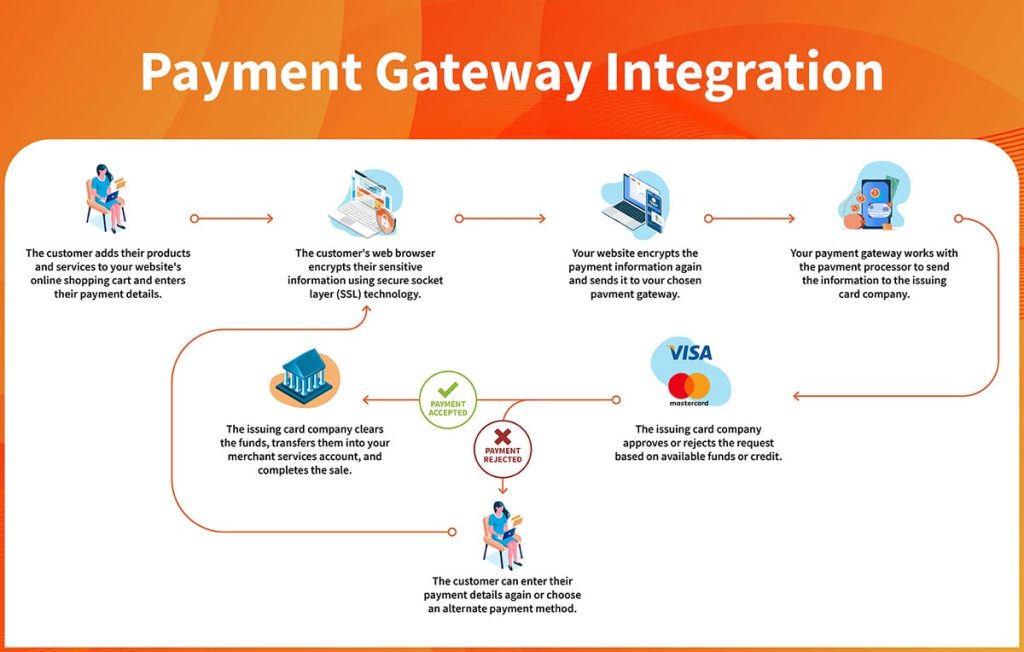

A payment gateway processes credit card payments for online stores. It facilitates the transfer of information between the payment portal (e.g., a website) and the acquiring bank. Choosing the right payment gateway directly impacts your business, influencing customer satisfaction and revenue.

Types of Payment Gateways

Understanding the types of payment gateways is crucial before integration. Your choice depends on your business model, technical capabilities, and customer expectations.

1. Hosted Payment Gateways

Hosted payment gateways redirect customers to a third-party site for payment processing. Examples include PayPal, Amazon Pay, and Stripe Checkout. After the transaction, customers return to your site.

Advantages:

- Simplicity: No need for PCI DSS compliance; the third-party provider handles sensitive data.

- Security: The provider manages all security measures, reducing risk.

Disadvantages:

- Reduced Conversion Rates: Redirecting customers away from your site can lead to cart abandonment.

- Limited Customization: The payment process cannot be fully customized to match your branding.

2. Non-Hosted (Integrated) Payment Gateways

Non-hosted gateways allow customers to complete their payments directly on your site without redirection. Examples include Braintree, Authorize.Net, and Checkout.com.

Advantages:

- Enhanced User Experience: Customers remain on your site, increasing conversion rates.

- Branding Control: The checkout process can be fully customized to reflect your brand.

Disadvantages:

- PCI Compliance Required: Your site must meet PCI DSS requirements.

- Technical Complexity: Integration requires a developer and ongoing technical support.

3. Self-Hosted Payment Gateways

Self-hosted payment gateways involve the merchant collecting payment details on their website and then sending them to the payment gateway’s URL. This method is typically used by large businesses with the technical capability to maintain high levels of security.

Advantages:

- Full Control: Complete control over the user experience and payment process.

- Advanced Security Features: Customizable security options tailored to your business needs.

Disadvantages:

- High Technical Requirements: Requires a dedicated IT team to manage security and PCI compliance.

- Cost: More expensive to implement and maintain compared to hosted options.

Steps to Integrate a Payment Gateway

Integrating a payment gateway involves several key steps. Here’s a general roadmap to guide you through the process:

1. Preparation

- Select a Payment Gateway: Consider your business model, transaction volume, and customer preferences. Ensure that the gateway supports multiple currencies if you operate internationally.

- Install an SSL Certificate: SSL encryption is essential for securing sensitive payment data.

- Set Up a Merchant Account: A merchant account is required to process payments. This account will receive funds from customer transactions.

- Review PCI Compliance Requirements: Ensure that your site complies with PCI DSS standards to protect customer data.

2. Solution Configuration

- API Integration: Most payment gateways provide an API (Application Programming Interface) for integration. Follow the gateway’s documentation to integrate the API with your site.

- Test the Integration: Before going live, thoroughly test the integration to ensure that transactions are processed smoothly and securely.

- Implement Security Measures: Utilize tokenization and encryption to protect sensitive data. Ensure that your gateway offers fraud detection tools.

3. Testing

- Run Multiple Test Transactions: Use test accounts to simulate transactions and check for any issues.

- Monitor and Optimize: After going live, monitor the payment process and make adjustments as needed to optimize performance.

Example Table: Comparison of Popular Payment Gateways

| Gateway | Type | Transaction Fee | Supported Currencies | PCI Compliance | Key Features |

|---|---|---|---|---|---|

| PayPal | Hosted | 2.9% + $0.30 | 25+ | Not Required | Easy integration, broad user base |

| Stripe | Integrated | 2.9% + $0.30 | 135+ | Required | Advanced API, customizable checkout |

| Braintree | Integrated | 2.9% + $0.30 | 130+ | Required | Multi-currency support, fraud protection |

| Authorize.Net | Integrated | 2.9% + $0.30 | 10+ | Required | Recurring billing, customer data storage |

| Checkout.com | Integrated | Custom Pricing | 150+ | Required | High scalability, extensive global reach |

Importance of PCI Compliance

Payment Card Industry Data Security Standard (PCI DSS) compliance is critical. Non-compliance can lead to significant fines and increased vulnerability to data breaches. For integrated or self-hosted gateways, ensure that your website meets all PCI DSS requirements. These include:

- Data Encryption: Encrypting cardholder data during transmission.

- Access Control: Limiting access to cardholder data to authorized personnel only.

- Regular Security Testing: Conducting vulnerability scans and penetration testing to identify and address security weaknesses.

According to the PCI DSS documentation, non-compliance penalties range from $5,000 to $100,000 per month, depending on the severity of the breach. Prioritize PCI compliance when integrating a payment gateway.

Integrating Mobile Payment Options

As of 2023, over 60% of online transactions are conducted via mobile devices. Ensure that your payment gateway supports mobile payments to cater to this growing segment. Popular mobile payment options include Apple Pay, Google Pay, and Samsung Pay, which offer fast and secure payment processing.

When selecting a payment gateway, ensure it supports mobile payments and offers a seamless user experience across devices. According to Visa’s official guidelines, mobile payment solutions should be easy to integrate, provide robust security, and offer a quick checkout experience to prevent cart abandonment.

Example Table: Mobile Payment Support by Payment Gateway

| Gateway | Apple Pay Support | Google Pay Support | Samsung Pay Support | Mobile SDK Availability |

|---|---|---|---|---|

| PayPal | Yes | Yes | Yes | Yes |

| Stripe | Yes | Yes | Yes | Yes |

| Braintree | Yes | Yes | Yes | Yes |

| Authorize.Net | Yes | Yes | Yes | Yes |

| Checkout.com | Yes | Yes | Yes | Yes |

Chargeback Prevention and Merchanto.org

Chargebacks are a significant concern for online businesses, leading to lost revenue and increased processing fees. Partnering with a reputable chargeback prevention service is essential. Merchanto.org is an official partner of VISA and MasterCard in the chargeback prevention sector, offering advanced tools and strategies to help businesses reduce chargeback rates. By integrating their services, you can protect your business from fraudulent transactions and disputes. For more information, visit their website.

Conclusion

Integrating a payment gateway into your website is a crucial step in establishing a secure and efficient online business. By choosing the right payment gateway, ensuring PCI compliance, and implementing mobile payment options, you can enhance the customer experience and drive higher conversion rates. Remember to thoroughly test the integration and continuously monitor its performance to ensure that your payment process remains smooth and secure.

Example Table: Transaction Limits and Fees for Popular Payment Gateways

| Gateway | Minimum Transaction | Maximum Transaction | Monthly Fee | Supported Payment Methods |

|---|---|---|---|---|

| PayPal | None | $10,000 | None | Credit/Debit Cards, PayPal, Venmo |

| Stripe | $0.50 | $999,999.99 | None | Credit/Debit Cards, ACH Transfers, Klarna |

| Braintree | None | Custom Limits | None | Credit/Debit Cards, PayPal, Google Pay, Apple Pay |

| Authorize.Net | None | Custom Limits | $25/month | Credit/Debit Cards, eChecks |

| Checkout.com | None | Custom Limits | Custom Pricing | Credit/Debit Cards, ACH, Digital Wallets |