Chargebacks are a common issue for merchants, especially in e-commerce. Mastercard reports that over 86% of chargebacks are either fraudulent or avoidable, emphasizing the need for effective chargeback prevention and dispute strategies. This guide will provide a clear, practical approach to winning chargeback disputes and reducing the chances of them occurring in the first place.

Understanding the Chargeback Process

Chargebacks occur when a cardholder disputes a transaction and requests a refund through their bank or card issuer. Merchants often face chargebacks due to product dissatisfaction, fraud, or failure to deliver the promised goods or services. To resolve these disputes effectively, it’s important to understand how the chargeback process works.

Chargeback Life Cycle

- Customer initiates a dispute: The cardholder contacts the issuing bank to dispute a transaction.

- Issuing bank notifies the acquirer: The dispute is forwarded to the merchant’s acquiring bank.

- Merchant’s response: The merchant is given a chance to respond with evidence.

- Bank decision: The bank reviews the evidence and decides the outcome.

- Arbitration: If unresolved, the dispute can go to arbitration with Visa or Mastercard mediating.

Each card network has its own set of rules governing chargebacks. Visa and Mastercard use specific reason codes to classify disputes, and merchants must respond accordingly.

Key Steps to Win Chargeback Disputes

1. Identify the Chargeback Reason Code

Each chargeback is accompanied by a reason code that specifies why the transaction is being disputed. Knowing the exact reason code helps merchants gather relevant evidence. Common reason codes include:

- Product not received: Visa 13.1, Mastercard 4855.

- Unauthorized transaction: Visa 10.4, Mastercard 4837.

Properly identifying the reason code is critical for crafting a strong response, as it directly informs the type of evidence required.

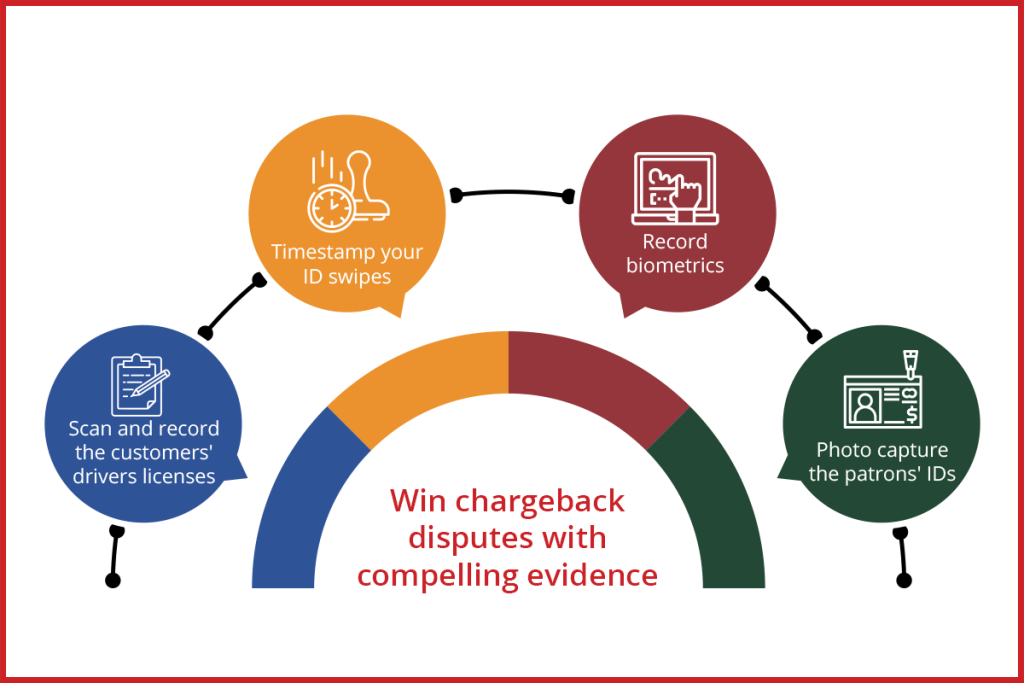

2. Gather Evidence

Winning a chargeback dispute depends on the strength of the evidence submitted. This may include:

- Proof of delivery: Signed receipts or tracking information.

- Product/service descriptions: Clear, accurate descriptions.

- Customer communications: Email or chat logs showing interaction.

- Identity verification: Address Verification Service (AVS) and Card Verification Value (CVV) match.

Fact: Visa data shows that merchants win over 60% of disputes when they submit appropriate evidence.

Data Table 1: Chargeback Win Rates Based on Reason Codes

| Reason Code | Win Rate for Merchants | Required Documentation | Source |

|---|---|---|---|

| Unauthorized transaction | 70% | Proof of customer authorization | Visa, Mastercard |

| Product not received | 65% | Proof of delivery | Visa, Mastercard |

| Fraudulent transaction (true fraud) | 55% | AVS, CVV, 3D Secure verification | Stripe, Braintree |

| Friendly fraud | 45% | Customer identity verification | Checkout.com |

This table provides an overview of the average win rates based on different types of chargeback claims. Having the right documentation is critical to successfully defending against disputes.

3. Write a Rebuttal Letter

The rebuttal letter is essential in contesting a chargeback. It should clearly state why the dispute is invalid and provide evidence that supports your case. Keep the letter factual and professional, avoiding unnecessary language.

4. Submit Within the Deadline

Chargeback disputes must be responded to promptly. Card networks such as Visa and Mastercard have strict deadlines for responding to disputes—usually within 30-45 days. Failure to meet these deadlines results in automatic losses, making it crucial to manage responses carefully.

5. Collaborate with Payment Processors

Payment processors like Stripe, Checkout.com, and Braintree play a key role in managing disputes. These platforms offer tools for submitting evidence and tracking dispute progress. Utilize these resources to streamline the chargeback process.

Best Practices to Prevent Chargebacks

Preventing chargebacks is often easier than disputing them. Implementing preventive measures can reduce the frequency of disputes, ultimately saving businesses time and money.

1. Use Accurate Product Descriptions

A major cause of chargebacks is misleading or vague product descriptions. Ensure that all product listings and service descriptions are clear, accurate, and detailed.

2. Offer Responsive Customer Service

A Mastercard study found that 32% of chargebacks are the result of poor customer service. Resolving issues through customer support before they escalate to chargebacks can prevent disputes. Offering timely, effective customer support is key.

3. Employ Fraud Prevention Tools

Fraud prevention tools such as 3D Secure, AVS, and CVV can significantly reduce the chances of fraudulent transactions. These tools help verify the identity of the cardholder, preventing unauthorized transactions.

4. Use Clear Billing Descriptors

A common reason for chargebacks is confusion over unclear billing descriptors. Ensure that your business name and contact information are clearly displayed on transaction receipts and billing statements to avoid disputes from customers not recognizing the charge.

Data Table 2: Top Causes of Chargebacks and Preventive Measures

| Cause of Chargeback | Percentage of Occurrence | Preventive Measure |

|---|---|---|

| Unrecognized transaction | 34% | Use clear billing descriptors |

| Fraudulent transaction (true fraud) | 29% | Implement 3D Secure, AVS, and CVV checks |

| Product not received | 21% | Provide detailed tracking information |

| Customer service issues | 16% | Offer prompt and responsive support |

This table outlines common causes of chargebacks and the preventive steps that merchants can take to minimize disputes.

Role of Arbitration in Chargeback Disputes

When a dispute cannot be resolved through representment, it may proceed to arbitration. Arbitration involves a third-party mediator, typically Visa or Mastercard, making the final decision. Arbitration can be costly, with fees often ranging from $250 to $500 depending on the card network.

Arbitration Considerations:

- Prepare comprehensive evidence: Make sure all relevant documents are included.

- Be aware of costs: Arbitration fees can be significant, so ensure the case is worth pursuing.

Partnering with Merchanto.org for Chargeback Prevention

Preventing chargebacks is critical for long-term success. Merchanto.org, an official partner of VISA and Mastercard, specializes in chargeback prevention and dispute management. Merchants can benefit from their expertise to reduce disputes and improve their chances of winning chargebacks. For more details, visit Merchanto.org.

Useful Data on Chargebacks

Below is additional data on chargebacks, focusing on the success rates of different preventive strategies and the impact of using third-party solutions.

| Preventive Measure | Success Rate | Cost of Implementation |

|---|---|---|

| 3D Secure implementation | 90% reduction in fraud disputes | Low to moderate |

| AVS and CVV match | 85% reduction in unauthorized transactions | Low |

| Clear billing descriptors | 70% reduction in unrecognized charges | Low |

| Proactive customer support | 60% reduction in service-related disputes | Moderate |

This table highlights the effectiveness of various preventive strategies in reducing chargeback disputes.

Conclusion

Winning chargeback disputes requires a clear understanding of the process and attention to detail. Merchants must gather strong evidence, submit timely responses, and work closely with their payment processors. By following the steps outlined in this guide and implementing proactive measures, merchants can significantly improve their chances of success in chargeback disputes.

By taking these actions, merchants can mitigate the risks associated with chargebacks and focus on growing their businesses.