Chargebacks are a core part of the financial system, crucial for consumer protection and ensuring merchant accountability. This guide offers a clear, fact-based explanation of chargebacks, their processes, and their impacts on businesses and consumers alike.

What is a Chargeback?

A chargeback is a reversal of a transaction initiated by a bank or credit card issuer at the request of the consumer. Unlike a refund, which the merchant processes directly, a chargeback involves multiple parties, including the card network, issuing bank, and acquiring bank.

Key Differences Between Refund and Chargeback:

| Aspect | Refund | Chargeback |

|---|---|---|

| Initiator | Merchant | Consumer via Bank/Credit Card Issuer |

| Process | Direct between merchant and customer | Involves banks and payment networks |

| Purpose | Customer dissatisfaction or error | Dispute of a charge, often for fraud |

Data Snapshot:

- In 2023, there were 1.8 billion chargebacks globally, underscoring their role in the payment ecosystem.

- According to Mastercard, 30% of chargebacks are due to fraud, while 20% stem from product or service disputes.

How the Chargeback Process Works

The chargeback process has several key steps:

- Initiation: The cardholder disputes a charge with their issuing bank.

- Review: The bank assigns a reason code and forwards the chargeback to the acquiring bank via the card network.

- Merchant Response: The merchant can accept the chargeback or provide evidence to dispute it.

- Final Decision: The issuing bank reviews the evidence and makes a decision.

Chargeback Reason Codes:

| Reason Code Category | Description | Example |

|---|---|---|

| Fraud | Unauthorized transaction | Stolen credit card used |

| Consumer Dispute | Product not as described | Item significantly different |

| Processing Errors | Incorrect transaction amount | Double charging |

| Authorization | Payment authorization failed | Expired card used |

Useful Fact: Merchants typically pay a fee of $20 to $100 per chargeback.

Types of Chargebacks

Understanding the types of chargebacks helps in preventing them.

- Fraudulent Chargebacks:

- Result from unauthorized transactions, often due to stolen credit card information.

- Consumer Disputes:

- Occur when a product is not delivered as promised or does not meet expectations.

- Processing Errors:

- Result from mistakes during the transaction process, such as incorrect amounts or duplicate charges.

- Authorization Issues:

- Occur when a payment is processed without proper authorization.

Legal and Regulatory Framework

Chargebacks are governed by regulations that protect consumers. In the U.S., the Fair Credit Billing Act (FCBA) covers credit card chargebacks, allowing consumers 60 days from the billing date to dispute a charge. Regulation E under the Electronic Fund Transfer Act (EFTA) governs debit card chargebacks.

Global Chargeback Regulations:

| Region | Key Regulation | Time Frame for Dispute |

|---|---|---|

| United States | Fair Credit Billing Act (FCBA) | 60 days from billing statement |

| Europe | Payment Services Directive (PSD2) | Varies by country, typically 8 weeks |

| Canada | Code of Conduct for the Credit and Debit Card Industry | 90 days from transaction date |

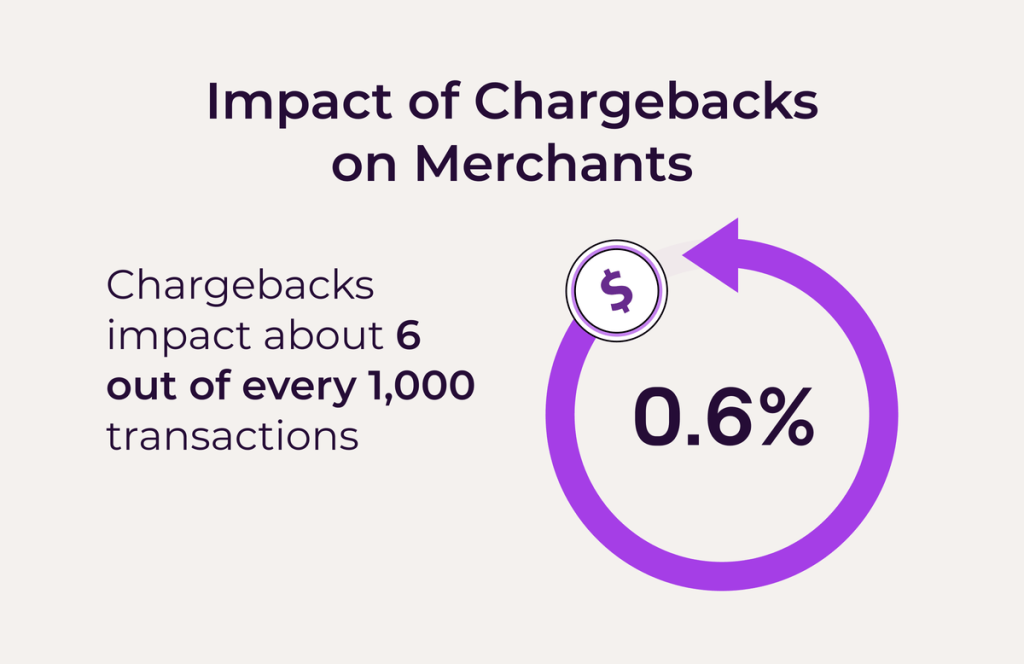

Impact of Chargebacks on Merchants

Chargebacks have significant financial and operational impacts on merchants. The immediate effect is lost revenue from the disputed transaction, but there are also long-term effects.

Financial Impact:

- Chargeback Fees: Merchants pay $20 to $100 per chargeback.

- Increased Costs: High chargeback rates can result in higher processing fees or even termination of merchant accounts.

Operational Impact:

- Time-Consuming Disputes: Disputing chargebacks can be resource-intensive.

- Negative Reputation: Frequent chargebacks can damage a merchant’s reputation, affecting future sales.

Chargeback Ratios:

Merchants with chargeback ratios above 1% are often deemed high-risk by payment processors like Stripe and Braintree.

Preventing Chargebacks

Preventing chargebacks requires a proactive approach.

Prevention Strategies:

- Transparent Communication:

- Provide clear product descriptions and terms of service.

- Ensure customers understand return and refund policies.

- Efficient Transaction Handling:

- Use fraud detection tools like 3D Secure 2 and Address Verification Services (AVS).

- Implement secure payment gateways.

- Proactive Customer Service:

- Address customer complaints promptly to avoid chargebacks.

- Offer easy and quick refunds.

Merchants can reduce chargebacks by partnering with specialized providers like Merchanto.org, an official partner of Visa and Mastercard, offering tailored chargeback prevention services.

Chargeback Fraud and Misuse

Friendly fraud occurs when a customer disputes a legitimate transaction, often to receive goods or services for free.

Common Types of Chargeback Fraud:

- Buyer’s Remorse: Customers dispute charges due to regret.

- Hidden Motives: Customers falsely claim they didn’t receive the product or that it was defective.

Statistics:

- 21% of chargebacks in 2022 were friendly fraud, costing merchants billions.

- A Visa study found that 50% of cardholders who file a fraudulent chargeback do so again within 60 days.

Mitigation Strategies:

- Detailed Transaction Records: Keep comprehensive records of transactions, including shipping and communication logs.

- Customer Education: Educate customers on proper dispute procedures.

Conclusion

Chargebacks are integral to the banking and payment landscape, offering consumer protection but challenging merchants. Understanding the process, types, and prevention strategies can help businesses manage chargebacks effectively.

Key Takeaways:

- Chargebacks differ from refunds, involving a more complex reversal process through the payment network.

- Different types of chargebacks require specific prevention strategies.

- Legal frameworks such as the FCBA in the U.S. govern the chargeback process with specific timelines.

- Merchants should proactively prevent chargebacks to avoid financial losses and maintain good standing with payment processors.

By following these guidelines, businesses can minimize the impact of chargebacks and ensure smooth financial operations.