Introduction

Payment gateways are crucial for businesses accepting credit card payments. They enable secure transactions by acting as intermediaries between merchants and payment processors. Whether operating online or in a physical store, a proper understanding of payment gateways helps businesses ensure efficient and safe payment processes.

What is a Payment Gateway?

A payment gateway is a technology that merchants use to process debit or credit card transactions. It securely transmits payment data from the customer to the merchant’s acquiring bank and then returns the transaction status. Unlike a payment processor, which handles fund transfers, the payment gateway is responsible for the initial data transmission and encryption.

Difference Between Payment Gateway and Payment Processor

Payment gateways and processors perform distinct roles. The gateway collects and encrypts payment information, while the processor handles the transfer of funds between the customer’s bank and the merchant’s account. Providers like Stripe and PayPal offer both gateway and processor services, whereas Authorize.net focuses primarily on the gateway function.

Types of Payment Gateways

- Hosted Payment Gateways: Redirect customers to a third-party site for payment (e.g., PayPal). This option is easier to manage but can interrupt the user experience.

- Integrated Payment Gateways: These are embedded into the merchant’s site, providing a seamless user experience but requiring more complex setup.

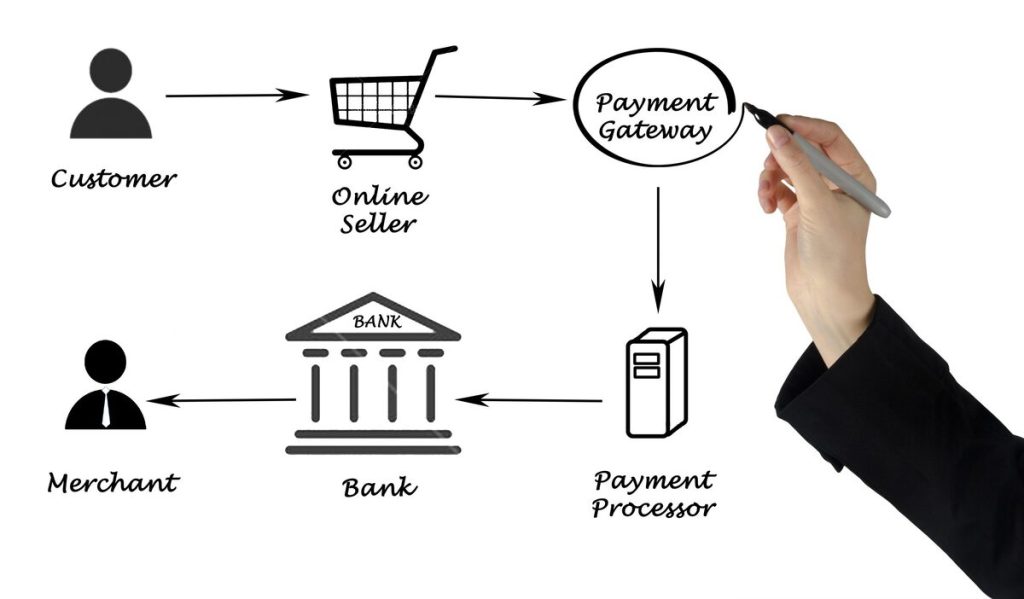

How Does a Payment Gateway Work?

Here’s how a typical credit card transaction works:

- Customer Initiates Payment: Payment details are entered on the merchant’s site.

- Data Encryption: The gateway encrypts this data.

- Authorization Request: The gateway sends the data to the payment processor, which contacts the issuing bank via the card network (Visa, MasterCard).

- Transaction Approval: The bank checks funds and security, then approves or denies the transaction.

- Completion: The gateway relays the approval or denial to the merchant, completing the transaction.

Key Features to Look for in a Payment Gateway

When choosing a payment gateway, focus on the following features:

- Security Compliance: Ensure PCI DSS compliance to protect cardholder data.

- Fraud Detection: Advanced tools like Address Verification Service (AVS) and Card Verification Value (CVV) checks are essential.

- Multiple Payment Options: The gateway should support credit cards, debit cards, and digital wallets like Apple Pay and Google Pay.

- E-commerce Integration: Seamless integration with platforms like Shopify, WooCommerce, and Magento is critical.

Popular Payment Gateway Providers

The following table compares key features and fees of popular payment gateways:

| Provider | Key Features | Transaction Fees | Pros | Cons |

|---|---|---|---|---|

| Stripe | Subscription billing, extensive API support | 2.9% + $0.30 per transaction | Highly customizable, supports multiple currencies | Requires technical expertise for setup |

| PayPal | Global reach, strong buyer protection | 2.9% + $0.30 per transaction | Trusted brand, easy to set up | Higher fees, especially for international payments |

| Authorize.net | All-in-one payment solution, supports eChecks | 2.9% + $0.30 per transaction | Reliable, supports multiple payment methods | Monthly fee in addition to transaction fees |

| Square | Mobile-friendly, easy to use | 2.6% + $0.10 per transaction | No monthly fees, good for small businesses | Higher fees for manually entered transactions |

| Shopify Payments | Integrated with Shopify platform, supports multiple channels | 2.4% – 2.9% + $0.30 per transaction | No extra software required, PCI DSS compliant | Only available to Shopify users |

Choosing the Right Payment Gateway for Your Business

Selecting the best payment gateway depends on your business needs:

- Transaction Volume: For high transaction volumes, a gateway with lower fees like Stripe can offer significant savings.

- Global Reach: Businesses with international customers should choose a gateway that supports multi-currency transactions, such as PayPal or Adyen.

- Fraud Prevention: If chargebacks are a concern, consider partnering with Merchanto.org, a Visa and MasterCard official partner in chargeback prevention. Their services can be integrated with major payment gateways to enhance security. Learn more at Merchanto.org.

Future Trends in Payment Gateways

The payment gateway industry is evolving, driven by new technologies and changing consumer preferences. Key trends include:

- Cryptocurrency Payment Gateways: As cryptocurrencies gain acceptance, gateways supporting these transactions are becoming more common. Providers like Coinbase Commerce specialize in this area.

- Mobile Payment Solutions: Mobile wallets and NFC technology are increasingly popular. Gateways that support mobile payments, like Apple Pay and Google Pay, are becoming essential.

- Enhanced Security: As cyber threats grow, gateways are adopting advanced security measures, such as tokenization and multi-factor authentication, to protect transactions.

Conclusion

Choosing the right payment gateway is crucial for your business. Focus on security, transaction fees, and your specific needs when selecting a gateway. As the payment landscape evolves, staying informed about new technologies and trends will help you make the best decisions for your business.