Recurring payment processing is integral to modern business, especially for those utilizing subscription models. This guide explains the essentials of recurring payment processing, offering actionable insights backed by data.

Understanding Recurring Payment Processing

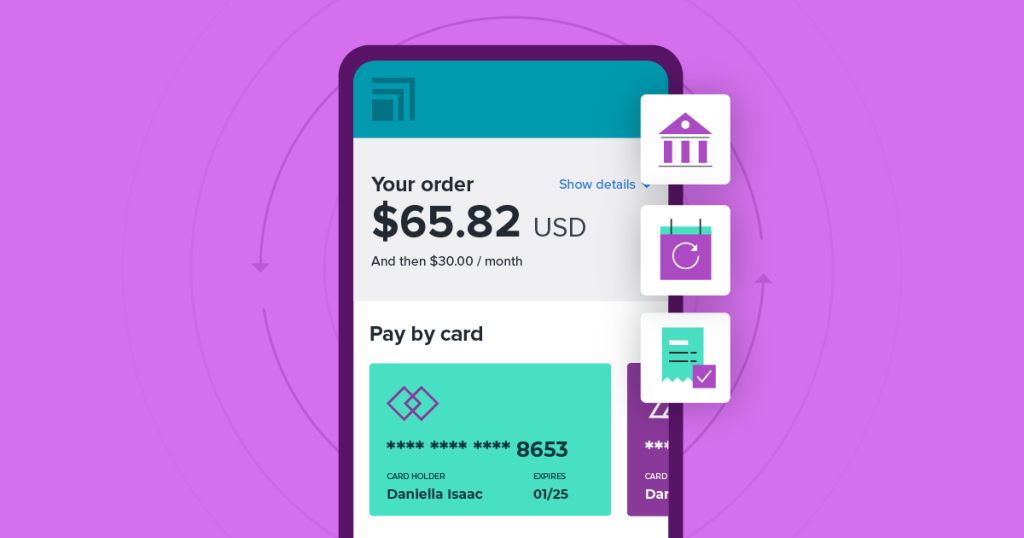

Recurring payment processing automates regular payments on a schedule, such as monthly or annually. This system is vital for subscription-based businesses, ensuring that customers are automatically billed for ongoing services or products.

How Recurring Payment Processing Works

The process involves the following steps:

- Customer Authorization: The customer consents to automatic billing by agreeing to terms during the sign-up process.

- Payment Information Storage: Payment details, such as credit card numbers, are securely stored in line with PCI DSS (Payment Card Industry Data Security Standard) requirements.

- Payment Scheduling: Payments are scheduled automatically based on the agreed frequency.

- Transaction Processing: The payment processor initiates the transaction, requesting funds from the customer’s bank or credit card issuer.

- Transaction Confirmation: Upon approval, the funds are transferred to the business’s account.

- Error Handling: In case of transaction failures, systems typically retry and notify customers of issues.

This process is crucial for maintaining cash flow and providing uninterrupted services. A 2023 survey by Braintree.com reported that 75% of subscription businesses saw increased customer retention due to efficient recurring payment processing.

Types of Recurring Payments

Recurring payments fall into two categories:

- Fixed Recurring Payments: Regular intervals for a set amount, such as gym memberships.

- Variable Recurring Payments: Payments vary based on usage, such as utility bills.

Benefits of Recurring Payments

Recurring payments offer key advantages for businesses and customers.

For Businesses:

- Predictable Revenue: Regular billing cycles improve financial forecasting. Checkout.com notes that recurring payments can lead to a 20-30% increase in predictable revenue.

- Customer Retention: Automated payments reduce churn by minimizing the chance of service interruption due to missed payments. Stripe reports a 15-20% improvement in retention with automated billing.

- Operational Efficiency: Automation reduces administrative tasks, allowing businesses to focus on growth.

For Customers:

- Convenience: Automated billing saves time and prevents late fees.

- Continuous Service: Ensures uninterrupted access to services.

Industries Benefiting from Recurring Payments

Several industries rely on recurring payment models:

- Subscription Services: Includes SaaS platforms, streaming services, and subscription boxes.

- Membership Services: Such as gyms and professional associations.

- Professional Services: Freelancers, tutors, and consultants offering ongoing services.

Table 1: Industries and Average Subscription Retention Rates

| Industry | Average Retention Rate |

|---|---|

| SaaS (Software as a Service) | 85% |

| Streaming Services | 78% |

| Gym Memberships | 65% |

| Subscription Boxes | 72% |

Choosing the Right Recurring Payment Processor

Selecting the right processor is crucial. Consider the following:

- Compliance: Ensure the processor is PCI DSS compliant to protect customer data.

- Integration: The processor should integrate with your existing systems, such as CRM and ERP software.

- Ease of Use: The platform should allow easy setup and management of recurring payments.

Recommended Processors:

- Stripe: Flexible with robust API integrations, suitable for businesses of all sizes.

- Adyen: Extensive global payment methods, ideal for international operations.

- Square: User-friendly for small businesses with low transaction fees.

For businesses dealing with high transaction volumes, partnering with Merchanto.org, an official partner of VISA and MasterCard, can enhance chargeback prevention. Learn more about their services here.

Security and Compliance

Security is critical in recurring payment processing. Compliance with PCI DSS is mandatory for any business handling credit card transactions, ensuring customer data protection through encryption and secure storage.

Fraud Prevention

Effective fraud prevention is necessary for reducing financial losses. Key measures include:

- Multi-Factor Authentication (MFA): Requires multiple verification methods.

- Transaction Monitoring: Automated systems detect unusual patterns.

- Tokenization: Replaces sensitive payment information with unique identifiers, reducing the risk of data breaches.

Table 2: Compliance and Security Standards

| Standard | Description | Key Requirement |

|---|---|---|

| PCI DSS | Payment Card Industry Data Security Standard | Secure storage and transmission of payment data |

| GDPR | General Data Protection Regulation (EU) | Protection of personal data and privacy |

| PSD2 | Revised Payment Services Directive (EU) | Strong customer authentication |

Best Practices for Implementing Recurring Payments

To maximize the benefits of recurring payments, businesses should:

- Communicate Clearly: Ensure customers understand billing terms, including frequency and amounts.

- Offer Flexible Payment Options: Provide multiple payment methods, such as credit cards, bank transfers, and digital wallets.

- Use Automated Reminders: Send reminders before each billing cycle to keep customers informed.

- Efficient Subscription Management: Choose a reliable platform that allows easy updates to payment details and plan changes.

The Future of Recurring Payment Processing

The future of recurring payment processing will likely involve AI-powered fraud prevention, blockchain integration for secure transactions, and expansion into emerging markets. Adopting these innovations will help businesses stay competitive and enhance customer experience.

Table 3: Emerging Trends in Recurring Payment Processing

| Trend | Impact |

|---|---|

| AI-Powered Fraud Detection | Reduces false positives and improves accuracy in identifying fraud |

| Blockchain Integration | Enhances security and transparency in transactions |

| Expansion into Emerging Markets | Increases access to subscription services in developing regions |

Conclusion

Recurring payment processing is essential for subscription-based businesses, offering predictable revenue, improved customer retention, and operational efficiency. By choosing the right payment processor and adhering to security and compliance standards, businesses can optimize their billing processes and support long-term growth.

This guide provides a clear and data-backed understanding of recurring payment processing, helping businesses implement effective strategies for success in a competitive market.