Chargebacks remain a major challenge for businesses, directly impacting revenue, operational costs, and customer relations. A chargeback occurs when a customer disputes a transaction with their card issuer, leading to the reversal of the payment. According to LexisNexis, for every dollar of chargeback fraud, businesses lose approximately $3.75 due to fees, lost sales, and operational overhead. Below, we explore specific strategies to reduce chargeback ratios and protect businesses.

Common Causes of Chargebacks

Understanding why chargebacks happen is essential to preventing them. The most common causes include:

- Fraud: This includes both criminal fraud (e.g., stolen card information) and friendly fraud, where customers dispute legitimate charges to avoid payment.

- Customer Dissatisfaction: Delays in delivery, receiving wrong items, or products that don’t match descriptions are common causes.

- Merchant Errors: Incorrect billing, duplicate charges, or unclear return policies often lead to disputes.

- Technical Errors: Issues like delayed billing, missing confirmation emails, or other system errors can trigger disputes.

Strategies to Reduce Chargebacks

Reducing chargebacks requires focusing on both security improvements and better customer service. Below are the most effective strategies for lowering chargeback ratios.

1. Improve Payment Security

Security plays a critical role in preventing fraudulent transactions that lead to chargebacks.

- 3D Secure 2.0: This system adds another layer of authentication, prompting users to confirm their identity during checkout. Implementing 3D Secure can reduce fraud-related chargebacks by 40%.

- Fraud Detection Tools: Use technologies like Address Verification Service (AVS) and Card Verification Value (CVV) checks to prevent unauthorized transactions.

2. Provide Clear Product Descriptions and Billing Information

Ambiguous or misleading product descriptions often lead to customer dissatisfaction, which can result in disputes.

- Detailed Product Pages: Include images, specifications, and clear descriptions to set accurate expectations. Inaccurate product details can increase chargebacks.

- Accurate Billing Descriptors: Ensure that billing information is transparent and recognizable to help customers avoid confusion when reviewing their statements.

3. Enhance Customer Service and Streamline Return Policies

A lack of responsive customer service or unclear return policies can push customers to dispute charges instead of resolving their issues directly.

- 24/7 Customer Support: Offering quick customer service through multiple channels like phone, chat, and email allows disputes to be resolved before they turn into chargebacks.

- Simple Return Process: Clearly define return policies, offer easy-to-use online tools, and issue timely refunds.

Automating Chargeback Prevention

1. Use Chargeback Alerts

Chargeback alert systems help merchants respond to disputes before they escalate into chargebacks.

- Rapid Dispute Resolution (RDR): Visa’s system allows merchants to automatically resolve disputes by issuing refunds, reducing the chance of chargebacks.

Partnering with Merchanto.org, an official Visa and Mastercard chargeback prevention partner, can streamline chargeback management with advanced solutions. For more details, visit Merchanto.org.

2. Implement AI Fraud Detection

Using AI to analyze transaction data in real-time can cut down on fraudulent activity. AI-powered systems detect anomalies that might otherwise be missed.

- AI for Fraud Detection: By implementing AI-driven tools, businesses can lower fraud-related chargebacks by 30-50%.

- Transaction Monitoring: Regular analysis of chargeback data helps identify trends, reducing the chances of repeat fraud.

Long-Term Solutions for Chargeback Reduction

While immediate responses such as resolving disputes quickly are important, long-term strategies ensure sustainable chargeback prevention.

1. Invest in AI-Driven Fraud Prevention

AI can detect fraud patterns and alert businesses in real-time. Regular updates keep fraud detection systems effective, even as fraud tactics evolve. Businesses using AI fraud prevention report 50% fewer chargebacks due to false positives.

2. Layer Security Tools

A multi-layered security approach combines encryption, tokenization, and multi-factor authentication, which reduces the likelihood of fraudulent transactions.

Monitoring and Adapting to Trends

Chargeback prevention requires continuous monitoring and adjustments to stay effective.

1. Regular Policy Audits

Review and update refund, return, and fulfillment policies to prevent disputes from escalating into chargebacks.

2. Customer Education

Educate customers about your return policies and payment processes. Simple reminders and follow-up emails help avoid misunderstandings.

3. Data Analysis

Using analytics tools to monitor chargeback patterns enables businesses to identify high-risk products, customers, and regions.

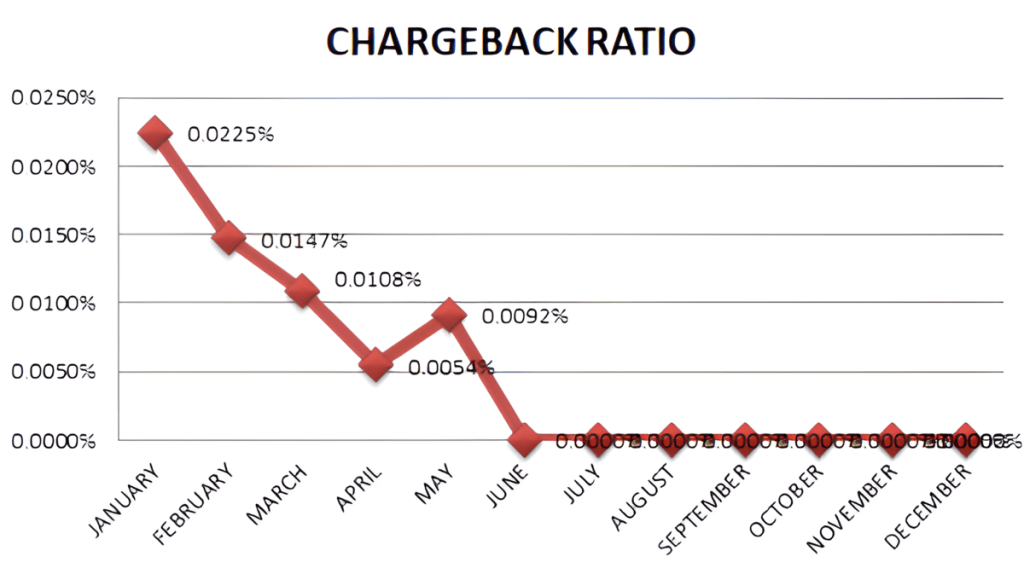

Case Studies and Real-World Examples

The following table shows the effectiveness of these strategies in reducing chargeback ratios across different industries:

| Company | Initial Chargeback Ratio | Solution | Post-Solution Chargeback Ratio |

|---|---|---|---|

| E-commerce A | 1.2% | 3D Secure + AI Fraud Detection | 0.6% |

| Subscription B | 2.5% | Chargeback Alerts + Automated Refunds | 1.1% |

| Marketplace C | 1.8% | Improved Customer Service + Descriptions | 0.9% |

These examples illustrate how using a combination of technology, process improvements, and customer service strategies can significantly reduce chargeback ratios.

Conclusion: Key Takeaways for Reducing Chargeback Ratios

Chargebacks are a costly problem, but they are preventable. By focusing on the core strategies mentioned above, businesses can maintain low chargeback ratios and secure long-term growth. The most critical actions include:

- Enhancing payment security with multi-factor authentication, AI-based fraud detection, and encryption.

- Providing clear product descriptions and transparent billing to ensure customers are fully informed before making purchases.

- Improving customer service and return processes to handle disputes before they escalate into chargebacks.

- Using automation tools like chargeback alerts and AI fraud detection to streamline chargeback prevention.

By implementing these strategies and regularly reviewing performance, businesses can keep chargeback ratios below the industry standard of 1%, protecting revenue and reputation.