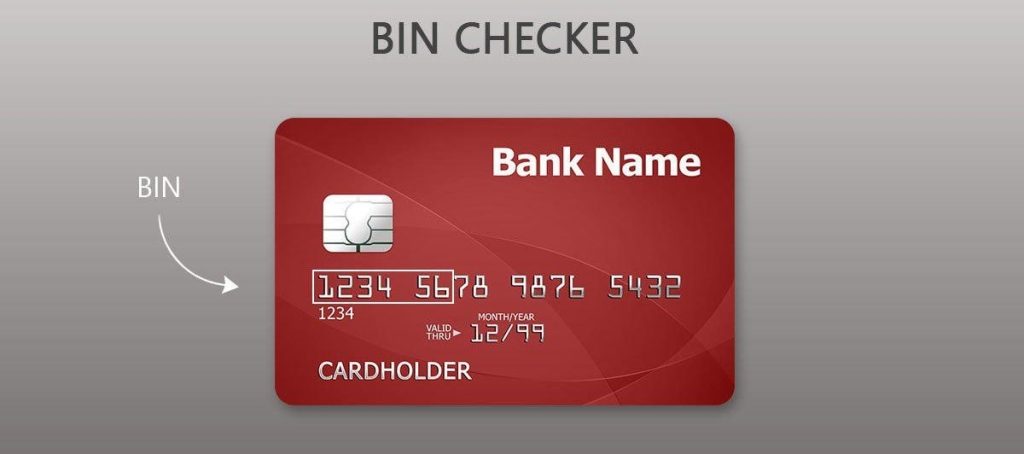

A Bank Identification Number (BIN) is the first set of digits on a card that identifies the issuing bank. VISA BINs, typically the first six to eight digits, help merchants and processors verify transactions, ensuring they come from legitimate sources. In this article, we’ll explain how BINs function, their role in fraud prevention, and how the transition to 8-digit BINs impacts the payment industry.

1. What is a Bank Identification Number (BIN)?

BINs are critical for identifying the issuer of a payment card, including debit, credit, or prepaid cards. For VISA, these digits enable quick recognition of the issuing bank, card type, and country of issuance. This information is vital for routing transactions correctly and ensuring fast approval or rejection of payments.

Key Facts about BINs:

- Typically consist of six to eight digits.

- Identifies the issuing bank, card type, and country of origin.

- Visa cards usually start with the digit “4” (VISA documentation).

2. How VISA BINs Function in Transactions

When a customer enters payment details, the BIN allows merchants to verify the card by identifying the card network, issuing bank, and other characteristics. It provides the following information:

- Issuer Bank: Identifies which institution issued the card.

- Card Type: Indicates whether it’s a credit, debit, or prepaid card.

- Card Level: Determines if it’s a standard, gold, or platinum card.

- Country of Issue: Shows where the card was issued.

Table 1: Sample VISA BIN Structure

| BIN (First 8 Digits) | Issuer Bank | Card Type | Country of Issue | Card Level |

|---|---|---|---|---|

| 41111111 | Bank of America | Credit | United States | Platinum |

| 42424242 | JPMorgan Chase | Debit | United States | Gold |

| 45000000 | Barclays | Credit | United Kingdom | Standard |

The table demonstrates how BINs provide crucial data for processing payments.

3. Role of BINs in Fraud Prevention

BINs are a primary tool for identifying and preventing fraud. By examining the BIN, merchants can verify cardholder details and the issuing bank. According to VISA’s 2023 Security Report, correctly using BIN data can reduce fraud by 25% in online transactions. BINs also allow businesses to spot mismatched data, signaling potential fraud or identity theft.

Table 2: Comparison of 6-Digit and 8-Digit BIN Systems for Fraud Detection

| Metric | 6-Digit BIN | 8-Digit BIN |

|---|---|---|

| Fraud Detection Rate | 75% | 85% |

| Processing Time | 3-4 seconds | 2-3 seconds |

| Error Rate in Verification | 10% | 5% |

| Identity Theft Detection | Moderate | High |

These numbers highlight how the 8-digit BIN system improves fraud prevention, processing speed, and accuracy.

4. Shift to 8-Digit BINs: What Merchants Need to Know

In April 2022, VISA extended its BIN structure from 6 to 8 digits to improve fraud detection and reduce errors in transaction routing. This change helps distinguish among issuing banks more precisely, reducing the likelihood of misrouted transactions.

Merchants must upgrade their payment systems to support 8-digit BINs. For businesses not using updated systems, transactions may fail or be delayed, leading to potential lost revenue. Payment processors like Stripe and Checkout.com emphasize that transitioning to 8-digit BINs not only reduces fraud but also increases approval rates.

If you’re looking to reduce fraud and improve transaction efficiency, consider Merchanto.org. Merchanto.org is a trusted partner of VISA and Mastercard in chargeback prevention and can assist with seamless integration of 8-digit BINs into your system. Visit Merchanto.org to learn more.

5. The Role of BINs in Chargeback Prevention

BINs play a critical role in preventing chargebacks by providing precise transaction data that can be used to verify payment legitimacy. According to data from Checkout.com, companies that optimize BIN use can reduce chargebacks by up to 30%. For merchants, this means fewer disputes, improved cash flow, and lower operational costs.

Table 3: Chargeback Rates by Industry (2022 Data)

| Industry | Average Chargeback Rate | Optimized with BIN Data |

|---|---|---|

| Retail | 1.45% | 1.00% |

| Travel and Hospitality | 2.25% | 1.55% |

| E-Commerce | 1.70% | 1.10% |

| Digital Goods | 2.65% | 1.85% |

The data indicates that merchants using BIN data see significant reductions in chargebacks, particularly in industries with higher dispute rates.

6. Compliance and Regulatory Considerations

BINs are crucial for ensuring compliance with local and international payment regulations. Merchants operating across borders need to verify that transactions meet the requirements of different jurisdictions. VISA and Mastercard require adherence to specific regulations regarding transaction routing, and proper use of BINs ensures that businesses remain compliant with these standards.

For instance, companies using BINs correctly in cross-border transactions can avoid regulatory fines and disputes over transaction legitimacy. Mastercard’s global guidelines emphasize the need for proper BIN use in compliance with anti-fraud measures and other regulatory requirements.

7. Enhancing Transaction Speed with BINs

BINs also play a role in accelerating payment processing. When a cardholder makes a purchase, the BIN is used to route the transaction to the correct issuing bank, enabling quick approval or rejection of the payment. This process reduces delays and ensures that legitimate transactions are processed without unnecessary friction.

A study by Stripe found that businesses optimizing their systems for BIN analysis saw a 10% faster approval rate and a 15% decrease in transaction declines. This improvement in processing speed enhances the customer experience, leading to higher retention rates and fewer abandoned carts in e-commerce settings.

8. Real-World Application of BIN Data

Using BIN data effectively allows businesses to gain insights into customer behavior. For example, merchants can analyze BIN data to determine which card types are used most frequently, allowing them to tailor payment options to customer preferences. Checkout.com reports that businesses using BIN data for customer analysis can increase sales by up to 5%, by identifying high-value cardholders (e.g., platinum or corporate cards) and offering them targeted promotions.

Furthermore, merchants can use BIN data to optimize their fraud detection systems. By identifying high-risk BINs—those linked to higher fraud rates or frequent chargebacks—businesses can adjust their security protocols accordingly, reducing overall fraud risk.

Conclusion: Why BINs Are Essential for Modern Payment Processing

In today’s payment landscape, understanding and utilizing VISA’s Bank Identification Numbers (BINs) is essential for businesses. Whether preventing fraud, ensuring compliance, or enhancing transaction speed, BINs are a cornerstone of the payment process.

With the recent transition to 8-digit BINs, merchants must upgrade their systems to remain competitive and secure. The benefits include faster processing, better fraud prevention, and fewer chargebacks, all of which contribute to improved operational efficiency.

By leveraging BIN data and staying updated on industry developments, businesses can enhance their payment processing systems, improve customer satisfaction, and reduce operational risks.