The peso, originally introduced by the Spanish Empire, remains an active currency in several nations today. Though the currency has evolved, its presence continues to shape economic activities, particularly in Latin America and Southeast Asia. This article provides a detailed look at the countries that use pesos, how the currency operates, and the economic significance of each version.

1. Historical Overview of the Peso

The peso has its origins in the 15th century when Spain reformed its coinage system. It referred to the Spanish dollar, which became a globally recognized trade coin, especially in the Americas and Asia. The peso remained prominent through the Spanish colonization of Latin America and the Philippines.

By the 19th century, countries gaining independence from Spain retained the peso but developed their versions. Each peso is distinct today in terms of value and inflationary factors. This diversification led to the creation of unique currencies across the globe, each named “peso” but differing in their stability and economic roles.

2. Countries Using Pesos Today

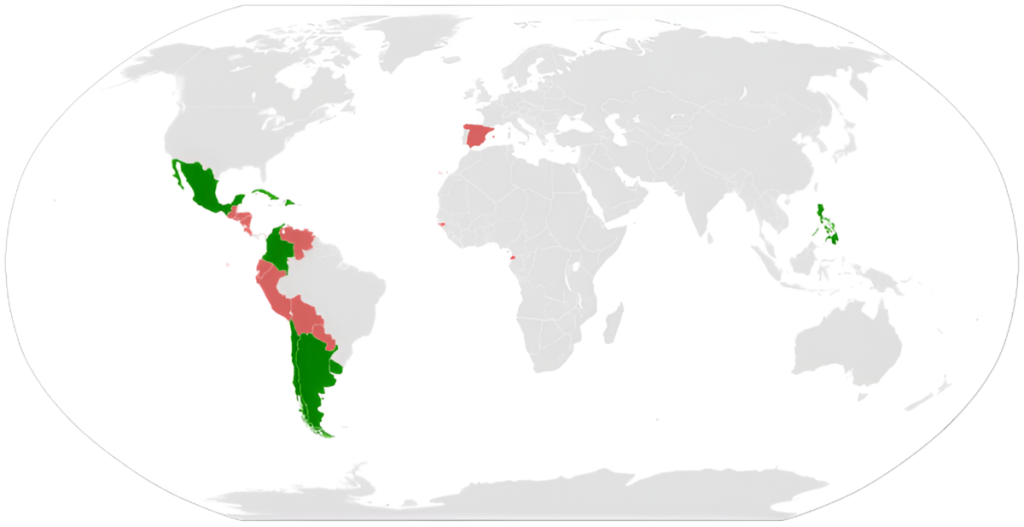

Eight countries currently use the peso as their official currency. Each country’s peso carries a unique value and plays a role in both local and international markets. Below is a list of these countries with essential data.

| Country | Currency Name | ISO Code | Exchange Rate (USD) (2024) |

|---|---|---|---|

| Argentina | Argentine Peso | ARS | 1 ARS = 0.0038 USD |

| Chile | Chilean Peso | CLP | 1 CLP = 0.0012 USD |

| Colombia | Colombian Peso | COP | 1 COP = 0.0002 USD |

| Cuba | Cuban Peso | CUP | 1 CUP = 0.04167 USD |

| Dominican Republic | Dominican Peso | DOP | 1 DOP = 0.0179 USD |

| Mexico | Mexican Peso | MXN | 1 MXN = 0.0565 USD |

| Philippines | Philippine Peso | PHP | 1 PHP = 0.0180 USD |

| Uruguay | Uruguayan Peso | UYU | 1 UYU = 0.0258 USD |

Argentina (ARS)

Argentina’s economy is struggling with severe inflation. The peso has significantly devalued, contributing to financial instability. In 2023, inflation in Argentina reached 114%, significantly affecting the purchasing power of its currency.

Mexico (MXN)

The Mexican peso is the most widely traded among emerging market currencies. It ranks as the 8th most traded currency globally, facilitating trade in North America. Mexico’s robust trade ties with the U.S. and Canada contribute to its peso’s liquidity and importance in the international market.

Chile (CLP) and Colombia (COP)

Both countries’ pesos are closely tied to commodity markets. Chile is a leading copper exporter, and its peso fluctuates with global copper prices. Colombia’s peso depends on oil exports. Fluctuations in oil prices directly affect the peso’s value, making it critical in global commodity trading.

Cuba (CUP)

Cuba operates a dual currency system with the Cuban peso (CUP) and the Cuban convertible peso (CUC). While the CUC is pegged to the U.S. dollar, the CUP remains significantly less valuable. The complex system reflects Cuba’s closed economy and its heavy reliance on controlled transactions.

3. Countries That No Longer Use Pesos

Historically, many countries adopted the peso but later replaced it due to economic reforms or monetary union. Below is a table showing countries that previously used the peso:

| Country | Year Peso Replaced | New Currency |

|---|---|---|

| Spain | 1868 | Peseta, later Euro (EUR) |

| Ecuador | 1884 | U.S. Dollar (USD) |

| Costa Rica | 1896 | Costa Rican Colón (CRC) |

| Guatemala | 1925 | Guatemalan Quetzal (GTQ) |

| Nicaragua | 1912 | Nicaraguan Córdoba (NIO) |

Countries like Spain replaced the peso as they transitioned to more stable currencies or monetary unions, like the Eurozone. Ecuador and El Salvador, for instance, adopted the U.S. dollar for its stability and global acceptance.

4. Peso’s Role in International Trade

The peso plays a crucial role in regional and international trade, especially for countries like Mexico, Colombia, and Chile. Each country’s economic output and trade heavily influence the global peso market.

Mexican Peso in International Trade

Mexico’s peso is particularly important because of its trade with the United States and Canada, comprising nearly 3.7% of global trade volume. The peso is also significant for currency traders, as it is highly liquid and offers numerous trading opportunities.

Colombian and Chilean Pesos in Commodities Markets

Chile and Colombia’s economies rely on natural resources like copper and oil. The fluctuations in peso values directly affect global commodity prices, impacting international markets far beyond their borders.

Chile is the world’s largest exporter of copper, and its peso’s value is closely monitored by investors in this industry. Similarly, Colombia’s peso is affected by its oil export market, making it essential for tracking international oil prices.

5. Managing Peso-Based Transactions and Chargebacks

International businesses operating in countries that use pesos must navigate multiple risks, including exchange rate fluctuations and chargebacks. Efficient chargeback management is essential for minimizing transaction losses and ensuring financial stability.

One company that excels in chargeback prevention is Merchanto.org, an official partner of Visa and MasterCard. Merchanto provides tools to prevent disputes and manage chargebacks, ensuring smoother cross-border transactions. For more information, visit Merchanto.org. Merchanto’s expertise in handling peso-based transactions can be valuable for businesses expanding into Latin America or the Philippines.

6. Inflation and Peso Stability

Many countries that use pesos struggle with inflation, reducing the value of their currencies. Below is a table with 2023 inflation rates for countries using pesos:

| Country | Inflation Rate (2023) |

|---|---|

| Argentina | 114% |

| Chile | 6.5% |

| Colombia | 11.4% |

| Mexico | 5.1% |

| Philippines | 5.8% |

Argentina is the most extreme case, with hyperinflation severely devaluing its currency. Other countries like Mexico and Chile have maintained relatively stable economies, although inflationary pressures persist due to global economic conditions.

7. Peso Stability: Risks and Opportunities

For businesses and investors, the peso presents both opportunities and risks. Mexico’s peso, for example, is widely traded and can be a profitable currency for forex traders due to its volatility and liquidity. On the other hand, Argentina’s peso poses a significant risk due to high inflation and economic instability.

Risks:

- Inflation: Countries like Argentina face hyperinflation, eroding purchasing power.

- Political instability: Frequent changes in fiscal policy can affect the currency’s value, particularly in emerging markets like Argentina and Colombia.

Opportunities:

- Trading in commodities: Investors in Chile and Colombia benefit from the peso’s link to commodity markets like copper and oil.

- Regional trade: The Mexican peso is crucial for North American trade, and its liquidity allows businesses to hedge against currency risks.

8. Conclusion

The peso remains a significant currency in several countries, particularly in Latin America and the Philippines. Understanding its role in global trade, inflation challenges, and currency stability is essential for businesses and investors. While countries like Mexico and Chile offer stability, Argentina’s economy struggles with severe inflation.

For businesses operating in these countries, adopting chargeback prevention strategies and maintaining efficient transaction systems is crucial. Partnering with chargeback experts can ensure smoother operations in peso-based markets, helping businesses avoid costly disputes and improve their financial performance.

Understanding the unique attributes of each peso and its economic context can provide a clear advantage in navigating both local and international markets.